Introduction

I've known about Boohoo since they listed in 2014 but, thanks to Paul Scott, I became much more aware of their attractions following a profit warning that halved their share price overnight. Sadly I didn't purchase any at the time and could only watch from the sidelines as the shares 10-bagged in 2.5 years. As an aside it took them a year to double from their 22p low, six months to double again and then six months to double yet again - so there was plenty of opportunity to join the party while it was in full swing.

However since peaking at 266p back in June 2017 the price has slumped by over 40% as concerns around the economy, falling high-street spending and slowing growth rates have taken hold. At the same time management are pouring money into new warehousing, additional business lines and keeping the website up-to-date; the big question is whether this capex is producing a decent return or not. So my aim with this analysis is answer a question: does the business deserve a premium rating (P/E > 50) or has it been puffed up by private investor interest? In a nutshell is this the next ASOS, with a 100-bagger share price, or the online equivalent of M&S?

Analysis

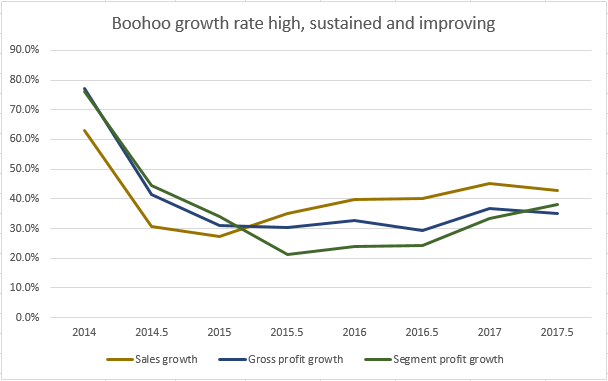

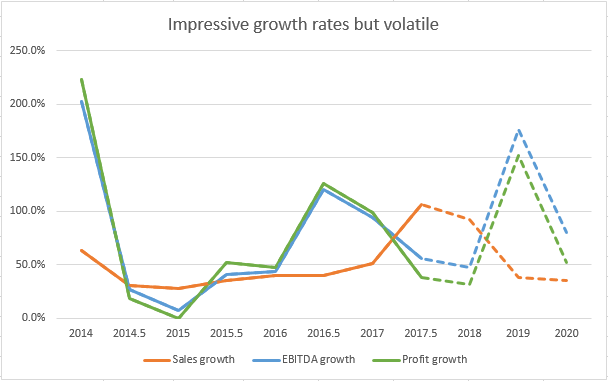

Let's start with growth then. Are sales and profits growing fast enough to deserve a high P/E? It turns out that growth is both excellent and persistent even without including sales from new labels PrettyLittleThing (PLT) and Nasty Gal. In H1 total sales grew by 43% while main brand segment profits grew at 38% although the latter figure excludes central group costs.

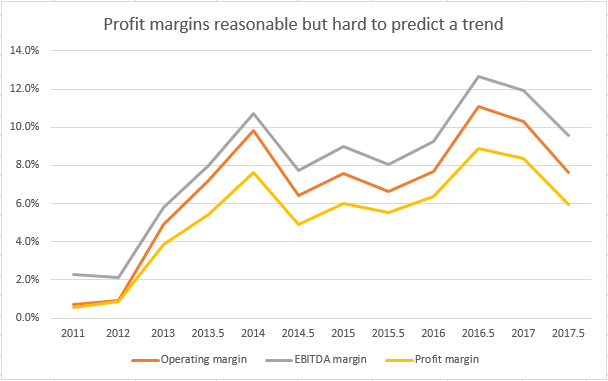

At the group level profit growth doesn't look quite so impressive as increasing costs in all areas of the business have worked against the high sales growth. This is why the reported margins have fallen recently. Right now it's hard to see a clear trend in margins, since they're only back to the level seen in 2014/15, but if the downward trend persists I'm going to start getting worried.

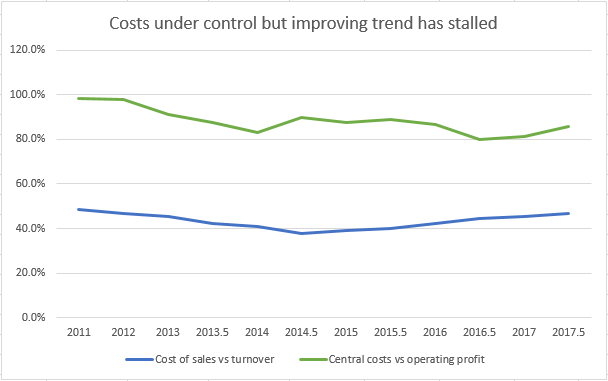

The obvious question then is what are the drivers behind these increased costs and are they setting a new normal for the group? At the top line the gross margin fell by 130 basis points to 53.3% in this H1. A far cry from the 62.2% achieved in H1 2014 and a continuation of the trend for gross margin to fall in every period since that high point. The culprit appears to be higher promotional activity which is perhaps not a surprise now that there are three distinct brands to advertise.

At the operating level the key issues seem to be rising marketing costs and supporting the building of new infrastructure (the warehouse expansion?) where this investment is taking place ahead of improved sales. Because the net profit margin is low, at 5-10%, these cost increases have a disproportionate impact on the bottom-line despite these costs remaining in line with historic levels:

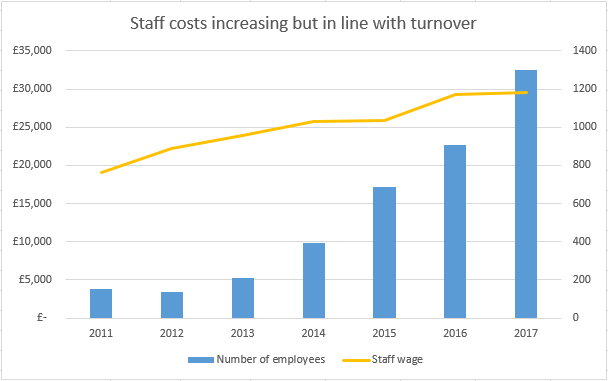

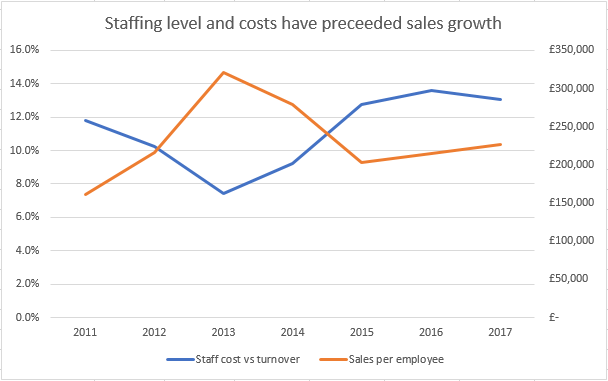

Another way of looking at costs is to consider employee costs with respect to sales. As Boohoo goes for all-out growth the employee count has exploded from ~150 to over 1300, while the average staff wage has leapt by over 50%, in the years since 2011.

This is all great if these increasing staffing levels and costs correlate with improving sales. I don't have a problem with a fast-growing company needing to take on more staff and perhaps paying them a little more as a reward for success. The difficulty comes when sales don't grow as fast and staffing costs eat into the profit margin. To some extent that is happening as the company ramps itself up to deal with sales that have yet to materialise. This is why staffing accounts for almost 14% of turnover, compared to 7.5% in 2013, and each employee accounts for a lot less turnover. As with other business costs this is another area that I'll be keeping an eye on in the upcoming results.

Still the stock market can be very forgiving just so long as underlying growth rates are maintained. The belief seems to be that a company can grow itself out of trouble, and into a high valuation, although woe betide it if growth falls away. Well ignoring the triple-digit growth seen pre-IPO (from a small revenue base) the sales and profits growth has generally come in ahead of 40% per annum although with a fair level of volatility. Analyst forecasts, for what they're worth, suggest that sales growth will moderate while profits rebound (possibly as some of the current cost pressures abate):

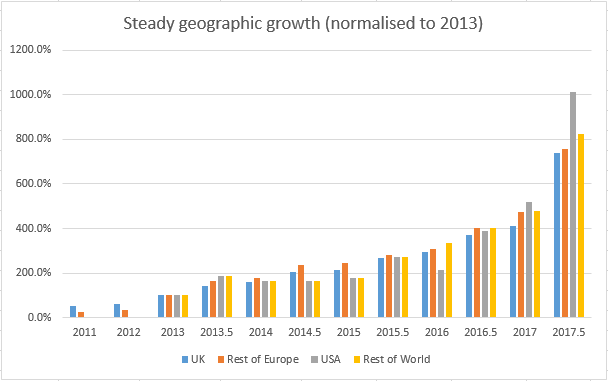

An aspect of Boohoo that really appeals is its geographic exposure. Obviously the UK remains the key market, with sales here substantially larger than the sum of all non-UK sales, but all of these markets have grown consistently since 2013 and there's no suggestion that any one market is favoured over another. What's impressive is that customers globally are satisfied from the central warehouse in Burnley and must presumably be happy with the speed of service and ability to return unwanted items. As an example US clients can get their clothes in 6 days for free, or 2-3 business days if they pay $15 for shipping, along with 28 days to make a return; pretty good service. Alternatively some Boohoo clothes are available through ASOS and perhaps non-UK delivery will be even faster that way? Anyway all regions have grown by almost 800% in five years which is pretty good going:

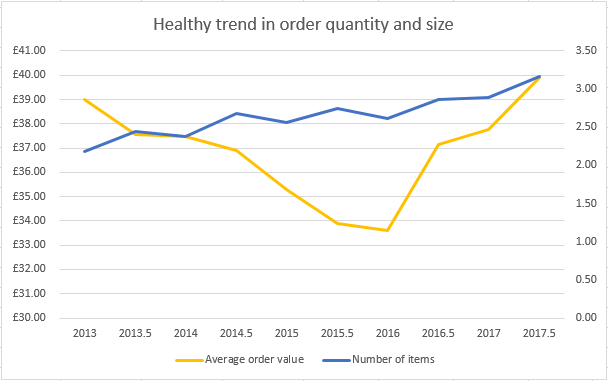

It's worth noting that this growth hasn't come at the expense of sales quality. The average order is now almost £40, the highest it has ever been, while more than three items are selected on average and this metric is on an upward trend. I don't know why the average order value slumped by >10% in the 2014-16 period but right now the pattern of extracting more from every customer interaction looks to be trending positively:

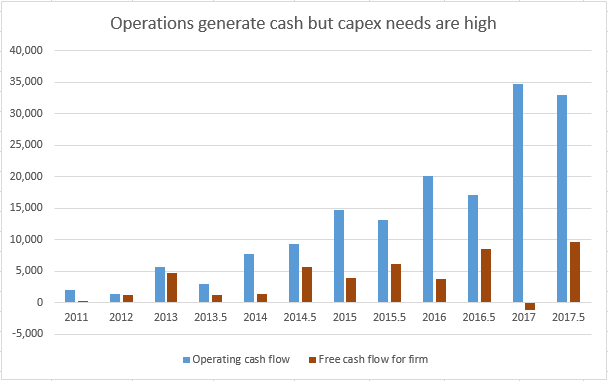

On a different matter Boohoo has lots of cash on its balance sheet, which is great, but its free cash-flow conversion rate (from operating cash-flow) has been pretty lousy for a number of years. The reason for this, which is no secret, is that Boohoo are pouring a lot of money into capex as they scale up their warehouse and website capabilities to deal with current and future growth. This doesn't stop them being cash generative but it does suggest that structurally much of this cash will continue to be diverted into capex needs as the company is growing:

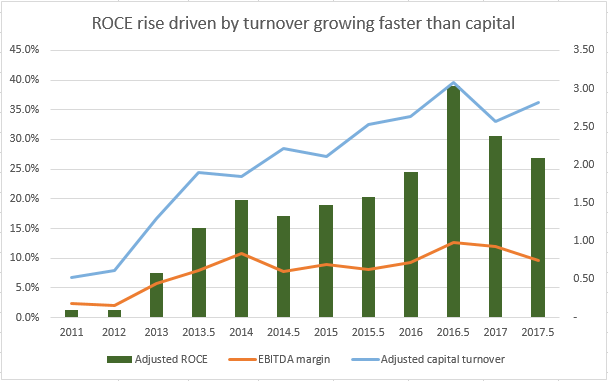

Still this ongoing capex isn't a problem, and should instead be welcomed, if each slug of additional capital produces a high and improving return. If so the capital is being sensibly employed to create an enterprise capable of generating high returns (and free cash-flow) when the level of capex reduces to more of a maintenance level. With Boohoo the numbers are somewhat distorted as prior to 2014 the business operated with very little capital but quite a lot of debt - paid off by flotation proceeds - with the result that ROCE calculations make little sense. To avoid this I've assumed that the £47m added at IPO was always there as capital, back to 2011, to normalise the ROCE figures somewhat. Looked at this way ROCE is on an upward trend to somewhere in excess of 25% (which is an excellent level). Given that capital is being put into warehousing and websites in advance of forecast sales this is a fine result:

My reading of the situation then is that while ROCE in the last few periods has fallen back, due to margin pressure, high sales growth in advance of capex growth is systematically pushing the ROCE higher. Since sales growth is forecast to continue with sales pretty much doubling in 2018, and then doubling again by 2020, I can see upwards pressure on ROCE continuing. So unless margins collapse or capex spirals out of control (which seems unlikely as this covers warehouses and software and not much else) then ROCE should stay high. As part of this the new brands, PLT and Nasty Gal, are quite small and have the potential for outstanding growth without much additional capital being required (although Boohoo only have an interest in 66% of PLT).

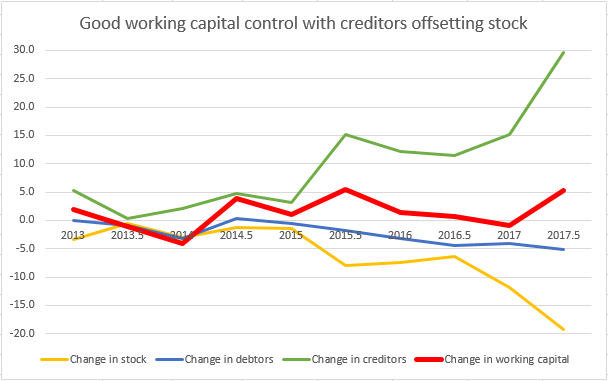

A different aspect of capital, of course, is working capital and the way in which growing companies are often required to pour money into this area in order to service increasing sales. The problem, typically, is that increased sales go hand-in-hand with rising levels of stock and often higher levels of receivables (since you have more customers buying your goods on potentially extended terms). This can cause a bit of a cash crisis as you need to bridge the gap between paying suppliers and receiving the cash which you're owed. Fortunately Boohoo have turned this cycle to their advantage by increasing the amount that they owe suppliers at exactly the same time as stock levels are rising. The result of this is that they've been able to handle sales increasing by 4x with only modest investment in working capital:

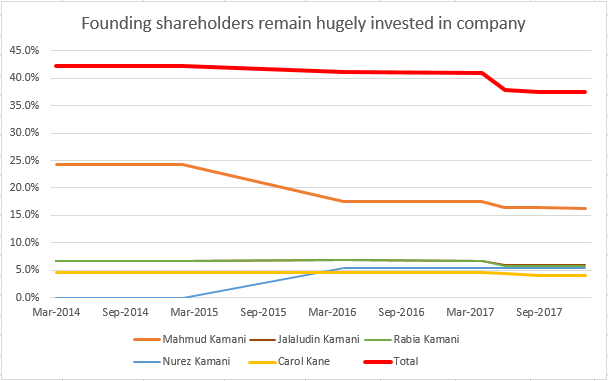

So it's fair to say that the founders have done an excellent job building the Boohoo business from nothing with little deviation from their core strategy: "Our vision is to be the leading e-commerce fashion market for 16 to 30 year-olds, which we will drive through our strategic priorities: Insight, Investment, Innovation and Integration." It's no real surprise that this process involves some growing pains, especially as the business matures and takes on more normal levels of profitability, but I think that there's plenty of growth left in the tank (especially overseas). This is probably why the founders have maintained a very large holding in the firm despite off-loading a small number of shares over the last few years:

What I hadn't realised, until I looked at the numbers, was just how few shares the Kamani family have sold and how they've shared the wealth generated by Boohoo. One example is Mahumd gifting 6.8% of the company to his brother Nurez and family in October 2015. Another example is how 133 employees were rewarded in June 2016 with meaningful equity to the tune of 2.8% of the company. When the opportunity to place shares has arisen, with the £50m placing at a tiny discount of 0.3%, major shareholders Mahmud, Jalaludin and Rabia didn't hugely reduce their stake. In fact, assuming a constant share count, the founders have only fallen from owning 42.3% of Boohoo to 38.0% in the last four years.

I think that I understand their continued optimism. If we look at the placing last year it raised £50m to support new warehousing vast enough to triple sales capacity. However the actual cost of this will be c£150m and yet the company only raised a third of this amount with these funds not really being required for the construction. Instead the company want to have enough cash around to finance an acquisition if an interesting one becomes available. I see all of these points as very positive since they point to a company that's growing fast, makes enough cash-flow to cover large capex costs and is prepared to bolt-on an interesting brand at the right price.

Conclusion

To answer my question then does Boohoo deserve to be rated on a P/E > 50 (which is after a 40% fall in share price remember)? Well there's a real quality business here which is being well run by incentivised management following a clear strategy. The board are clearly scaling up to match sales doubling and then doubling again in the next few years and analyst forecasts are in-line with this trajectory. This is fortunate since a nose-bleed rating is predicated on high and outstanding growth going forward with sales converting into profits. So I'm ok with the current rating but a lot depends on margins being maintained and that's what we'll find out in the coming results.

On the results front I would have expected a pre-close trading update by now, with a date for the final results, and its absence is my outstanding concern. On the whole I don't believe that Boohoo deserves to have been marked down so savagely in recent weeks but the lack of news breeds fear in uncertain times. Still online retailers are winning the customer battle and we know that Boohoo is gunning for a decent slice of the pie. With this backdrop there's no evidence that the (pretty simple) Boohoo model is broken and I'm inclined to stick with the Kamani family despite being more underwater than my stop-loss allows. Fortunately I only have a starter position as my investing rules don't allow me to scale up without a better than in-line trading statement. Fingers crossed that's what we'll get.

Disclaimer: The author holds shares in the company discussed here