One-line summary

NewRiver Retail is a well managed, growth seeking REIT that specialises in the UK food and value sector and should benefit from regional economic recovery in the long run.

Introduction

NewRiver Retail is a REIT (real estate investment trust) set up in 2009 to capitalise on investment opportunities made available by the financial crisis (with portfolios sold at knock-down prices by forced sellers). The founders of the trust have long experience and excellent track-records in this arena; in particular CEO David Lockhart's last company Halladale grew its NAV from 63.7p in 2001 to an offer price of 225p when taken-over in 2007. In total a shareholder return of 440%; great timing and an excellent result. The specific aim of NewRiver Retail is to repeat this level of success through opportunistic purchases, at a minimum yield gap, and active management of asset improvements.

The company certainly got off to a flying start by pre-arranging a management agreement with Scottish Widows before completing a number of off-market purchases, in the first year, and entering into a joint venture with Morgan Stanley. Since then the growth trajectory has been relentless although with a subtle shift in focus from mostly buying assets on their own account to engaging in joint enterprises where they provide the management expertise. Looking at the names of their recent heavyweight partners, such as PIMCO, it's clear that NewRiver Retail is seen as a safe pair of hands and it's a fair endorsement of management quality.

In the IPO admission document the directors put forward an intentional focus on retail, rather than the office sector, and this makes sense when considering historical volatility and returns, the size of the market and concomitant liquidity and the types of national tenants available with whom a relationship may be built. But concentrating on the food sub-sector for anchor stores might not be so golden any more given the turmoil amongst all of the operators and their scaling back of expansion plans and overall contraction. Will NewRiver Retail be left with empty premises if a retailer pays the penalty to break their lease?

Valuing a real-estate investment trust

Now trying to value NewRiver Retail is a bit of a step into the unknown for me. Standard valuation metrics are remarkably useless when it comes to assessing property investment companies - items such as free cash-flow, trade receivables and even headline profit margins are distorted by the focus on capital growth and a pipeline of occasional sales. In response to this NewRiver Retail provides EPRA profit and NAV values; these are designed to provide consistent and comparable figures across the industry.

As an aside the EPRA definition of profit principally aims to avoid capital value bias (which can be a bit subjective): EPRA earnings exclude investment property revaluations and gains on disposals, intangible asset movements and their related taxation and the REIT conversion charge. NewRiver Retail also disclose an EPRA Adjusted Profit measure which includes realised gains on disposals and adds back share option expense as it's an unrealised value.

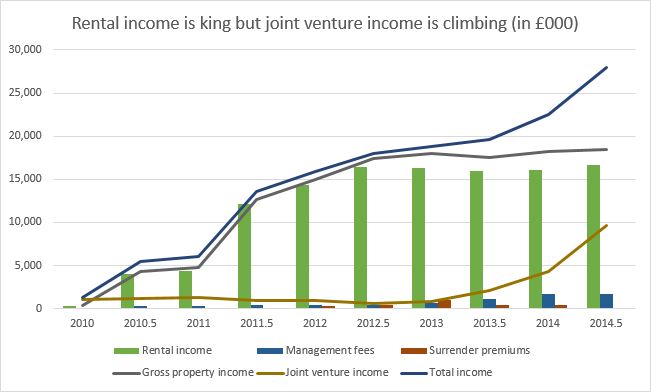

On this basis (excluding capital gains) income has grown steadily with a split across sources (principally rental and joint venture income):

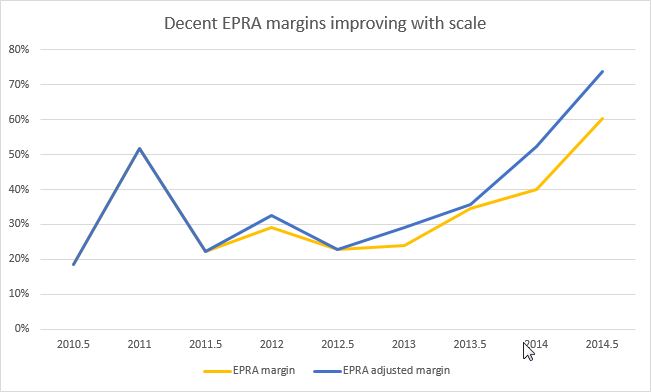

At the same time EPRA margins have risen dramatically in the last few years up to the 60-70% level. For comparison this is the same as the net profit margin when calculated from income sources only; so capital changes, whether due to revaluations or sales, are excluded.

I believe that the reason for this improvement is the dramatic scaling up of the investment portfolio as joint ventures have become an increasingly important feature and strong cost-control (management are quite explicit about how focused they are on collecting rent!). Even as the investment portfolio has diversified both by location and type of property the underlying overhead of managing the estate has remained constant:

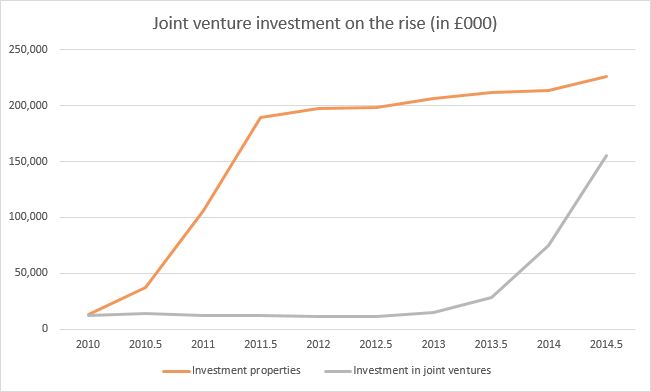

As for the portfolio of assets in the early days NewRiver Retail invested pretty much exclusively on its own account but in the last few years joint investment has sky-rocketed:

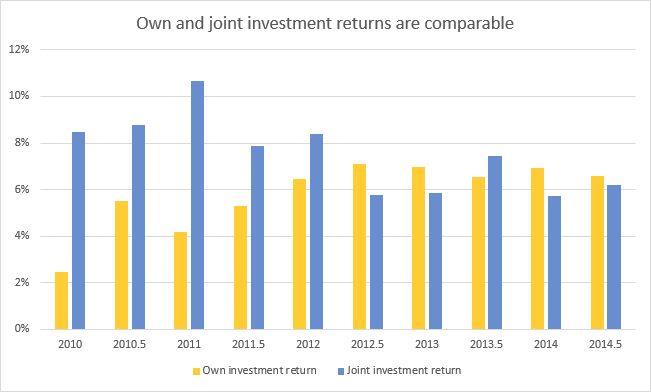

From the perspective of whether these joint ventures are a more profitable sideline that management like to mine or a major source of investment funds the evidence seems to support the latter idea. In the early years joint investment achieved a significantly better return on capital but the amounts deployed were limited; now that significant sums are involved the returns are broadly comparable:

Another key area to examine with REITs is the balance of debt and equity and how effectively income covers interest payments. This balance is rather multi-faceted since debt directly impacts on the gearing level (which the company aims to keep at 50-65% once fully invested) while equity has a claim on the underlying assets and leads to dilution for existing shareholders. With NewRiver Retail a decision on this has clearly been made since the net debt level has been static since 2011, at around £130M, while they have aggressively raised new funds with the share count rising by an eye-watering 10 times:

Quite some dilution for existing holders but each placing has been over-subscribed and the funds deployed quickly on specified purchases (such as the £150M raised over the last year). At the same time a high but sustainable level of debt has been taken on, from a panel of lenders, with this being actively managed to keep the blended interest rate low and the remaining time to maturity high.

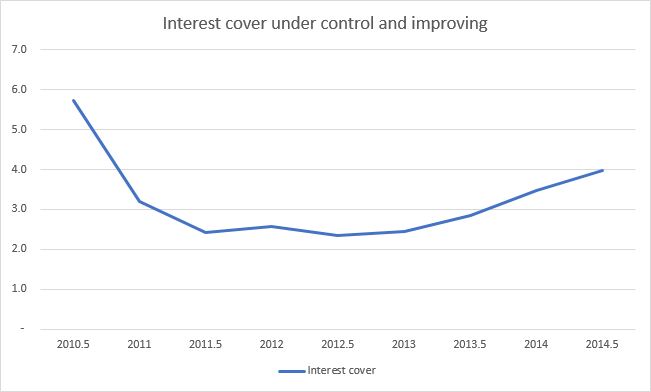

Typically interest cover compares net rental income to interest payable but here I've calculated a variation which adds net income to joint income and then divides this sum by the net interest paid overall. This seems to make sense given the investment split for NewRiver Retail and it's slightly more conservative as interest is due on CULS (Convertible Unsecured Loan Stock) also. So the interest cover is low, as you might expect for a property investment outfit, but it appears well managed and has improved substantially in the last couple of years:

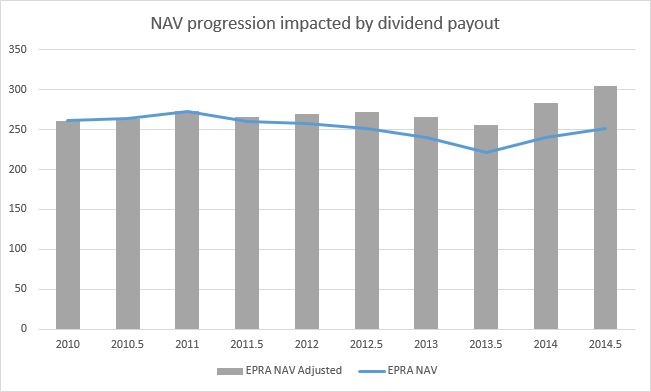

A key reason to invest in REITs, and perhaps their most widely followed metric, is the NAV of the underlying assets and expected increases in this through development and asset sales. Superficially NewRiver Retail appears to have performed poorly with the NAV rising from an initial value of 241p to a high of 273p in 2011 before dropping right back to 240p recently (although this is all against the headwind of a share count rising by 10x). However, by design, REITs must distribute 90% of their taxable income to shareholders (as a property income distribution) and thus this income isn't accumulated by the company. If the impact of these dividends is removed the underlying NAV would have grown to roughly 300p:

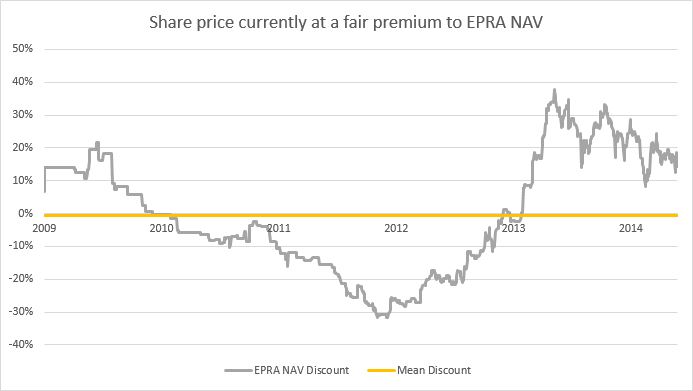

Related to the NAV is the share price since a trust trading below its asset value is often viewed as a bargain (assuming that the valuations are recent and reliable) while one trading above asset value is perhaps expensive and factoring in an expectation of future growth. With NewRiver Retail there's been a pretty significant shift in sentiment over a short period of time; a year or two ago the discount was large and, in retrospect, unsustainable. Now NewRiver Retail has recovered and is no longer 'cheap':

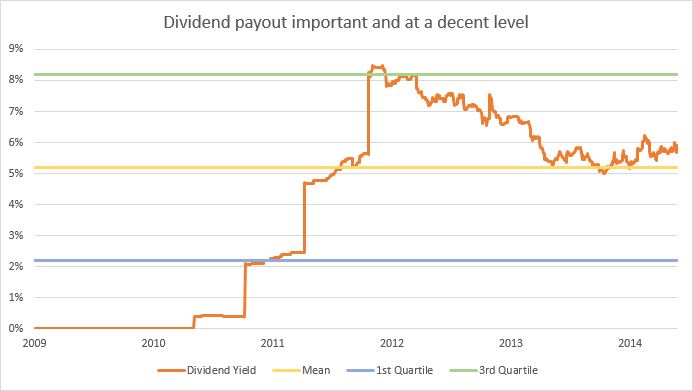

That said a year ago the premium hit an impressive peak of 37% over the NAV (222p in Sep 2013) while the gap is now less then 15% at the time of writing; a function of the NAV rising to 252p while the share-price has flat-lined. One possible driver for this recovery is the increasing dividend that the company is able to sustain and the yield that this translates into:

There's no doubt that management look upon dividends as an important component of shareholder return and I really feel that this focus on shareholders is more than skin-deep. For instance there is an excellent level of transparency concerning the properties in the portfolio; the concentration in the south-east is obvious but there's a good spread of shopping centres throughout England and Wales with retailers in the Food and Value sectors being dominant occupiers.

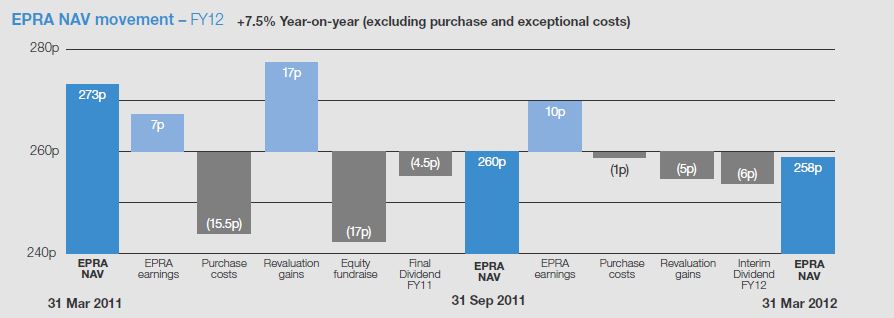

Alongside this the annual reports are a model of clarity with extensive commentary covering all of the major purchase and development events in some detail along with KPIs and progress against them. These KPIs are all very sensible and relate to shareholder returns, adding value through active management, purchase yield quality, IRR on disposals made and financing metrics. This level of detail suggests to me that management have their eye firmly on the ball. As an example of the level of disclosure I have found EPRA NAV movements, such as this one from 2012, very informative:

Recent activity and investments

Just in the September 2014 interim report NewRiver Retail outlined some impressive results: EPRA profit up by 120%, NAV up by 14% and assets under management up by 28% to £767M. Driving this transformation were £174M of acquisitions, at an average 8.2% yield, with £140M spent on a single portfolio and substantial growth in the PIMCO joint venture. At the same time the number of shares doubled and disposals bought in £34M. You could hardly ask for a more active or rewarding six months!

However the most intriguing item in the report, for me, concerns the progress that NewRiver Retail is making with the Marston's pub estate. This is a fairly unique transaction where the company purchased 202 unloved pubs (with a heavy concentration in the Midlands) in order to turn them into convenience stores and the like. A risky venture for sure but this is somewhat alleviated by Marston being contractually committed to leasing the pubs for 4 years while development occurs. Anyway early on the Co-Op signed up for 54 of the properties and this agreement has now expanded to 63 sites; so NewRiver Retail appear to be doing something right by tapping into the demand for smaller, local stores.

Since then the company has gone forwards with another placing; this time for £75M or just over 27M shares (which handily translates into the share count swelling by 27%). Curiously these funds are to be immediately deployed in paying off PIMCO so that they can take one of their joint venture portfolios entirely in-house; why PIMCO are looking to liquidate in this manner is unclear but hopefully it's for reasons unrelated to the actual management of this asset! Alongside this NewRiver Retail bought another shopping centre portfolio at a distressed price (of £19M when they last went for £40M). So all in all the third quarter of 2014 witnessed continuing vigour and opportunity; a profitable combination.

Conclusion

With NewRiver Retail, more than most shares, it's been a challenge to dig out the ratios and graphs that tell the most interesting tale. For a start it's a REIT, the listed history of the vehicle is short, it's expanded massively in this time and there's been a lot of change in the business. That said it's now the 3rd largest shopping centre owner/manager in the UK (which indicates either amazing growth or a fragmented market) with a consistent record of working with retailers and other stakeholders to add value. Then there are the partners such as PIMCO who must have performed extensive due diligence - so at a macro level the signals are all positive.

What we can see from the EPRA profit and NAV trends is that income is rising steadily, with a healthy profit margin, while costs are being controlled and the return on invested assets is stable. At the same time the NAV is steady rather than growing; fundamentally earnings and revaluation gains are applying upwards pressure but so far this has been dissipated by dividends, purchase fees and equity placing costs. What we really need is a reflation of property prices in the provinces but that seems unlikely in the near-term with the retail sector itself suffering.

It all adds up to a lot of future promise and the Midas share-tipping column says as much in this recent article. They point to all of the positives previously mentioned but with an additional twist: the lift in property values since the crash has been mostly confined to the M25 but it's only a matter of time before the ripples spread out to the regions. When this happens NewRiver Retail is in in ideal position to benefit; the beginning of this process is certainly alluded to in the recent management statement from LondonMetric.

On the valuation front NewRiver Retail is priced for success although with a handsome yield to recompense while waiting. With the past history of David Lockhart I feel that he's playing the long game and won't be letting the trust get snapped up until we're near the top of the market. What is a bit of a surprise, when looked at this way, is that management share holdings have barely budged since flotation; while they haven't sold any shares they didn't buy any either when the discount widened to over 30% in 2012. Considering the huge dilution that they've suffered since 2009 I find this lack of activity rather perplexing.

To put some meat on the bones here we know that David Lockhart initially invested £3.65M to get 1.46M shares (14.6%) while the remaining directors chipped in another million or so; in others words the board held about 25% of the company in total. Since then the placings have been soaked up by institutions (who now control 60% of the shares at least) and David Lockhart's stake is down to about 1.6%! Only Allan Lockhart has accumulated in a significant way and that's only taken him from 140,000 to 211,684 shares. Maybe the board are just hanging out for their new options package?

What this really suggests to me is that NewRiver Retail is one of those investments that will reward the patient. If the economic recovery continues as it has, and the board maintain their discipline regarding purchases, improvements and disposals, then the value will out with this investment vehicle. But the process will take time and that's part of the reason for there being such an attractive dividend (along with the REIT legislation that is). So I'm content to retain my holding but probably won't be adding until some injection of volatility sends the share price to a meaningful discount from the NAV.

Disclosure: the author holds shares in this company.

Note: if you fancy getting to grips with some aspects of REITs and taxation then these short papers from David Vogel are educational: Part 1 Part 2 Part 3