Next remains a class act and every new annual report just confirms this!

Introduction

I first looked at Next almost exactly a year ago and decided that it was just a bit too expensive to justify purchasing. At this point the share price was £64.50. A few months later, in February, I revisited the figures and reconsidered my position in the light of the board's switch from share-buybacks to special dividends. Even at a share price of £71.20 these payouts implied a yield north of 4%; pretty punchy for a £12bn company still-growing its mail-order offering. It turns out that these were both decent entry points with the share price now hovering around £79.50 and buybacks remaining off of the menu. The question that I'm interested in now is whether Next is still powering ahead; if it is then, after returning over 25% in the past year (including dividends), is it still worth purchasing?

Analysis

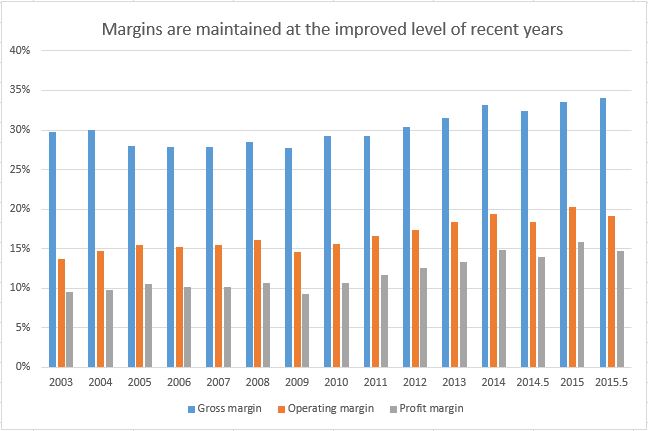

Using the half-year results published last month I've updated my spreadsheet. Margins are the first metric that I like to check as these represent the public face of profitability for a company. The news is good in that all margins have improved against the previous half-year. This implies that both buying (of goods) and staff costs are well under control. Set against the full-year results there is a slight drop evident but seasonality makes sense given how much scope Christmas offers for selling in volume at a top price:

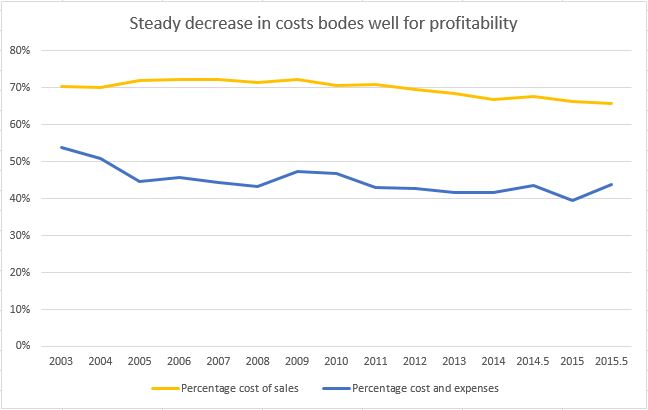

Looking at expenses the cost of sales percentage has been falling for the last decade while the operating cost percentage has remained flat. In layman's terms this means that Next's buying team are keeping charges down, possibly as a result of greater volume, while the board have managed to offset increasing labour and retail costs with efficiency improvements and margin hikes. It's rather pleasing that Next are keeping a lid on outgoings despite headwinds from living-wage legislation and building cost inflation. With the former it's plain that staff numbers are reducing as more experienced staff work longer hours for more money; this is just one of the knock-on effects of a regulated minimum wage. To achieve such consistency over more than a decade is a testament to the strength of this business:

The driving force behind this performance has been the company's focus on Next Directory. Growth here has seen sales tripling (from £500mn to £1.5bn) over the last decade (while retail turnover remains stuck at around £2.2bn) with margins diverging. Much of this growth has come from overseas with half-year sales here jumping by 24.1%. In-line with innovation elsewhere in the business Next are establishing local delivery hubs in foreign locations and this can only fuel further expansion. In contrast retail has been ex-growth for a long time while its operating margin has barely shifted from a baseline of 15% for as far back as I have records. In contrast Directory margins reached 25% a few years ago and have retained this high-ground ever since:

As part of the expansion of Next Directory the company has, historically, generated excellent returns from the difference in the interest rate which it charges customers (in the order of 25%) compared to the much lower rate that Next itself pays. This explains why the firm carries so much debt, despite being a cash-generating machine, as low-risk finance like this provides a great boost to profits. In the modern era though increasing numbers of customers are paying at the point of sale and the volume of new finance clients is declining; this is a serious threat to Next and they're re-vamping their credit offering to be more attractive (with lower rates and reduced minimum payment terms) compared to alternative forms of borrowing. This appears to be working and without impacting on the debtor day trend for Directory sales:

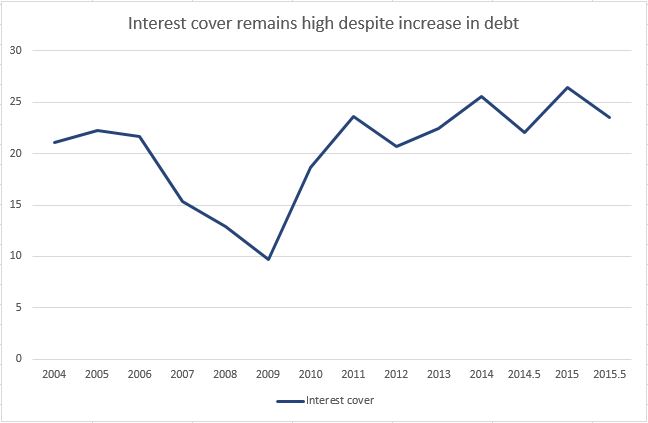

Actually the debt load of Next is worth examining further as the company suffers what appears, at first glance, to be a high gearing ratio of 180% and rising. The reason for this is partly the Directory loan book and partly a conscious result of share buybacks trimming the equity base of the company. From an affordability perspective though the interest cover on this borrowing has remained above 20x for many years and shows no sign of weakening. Thus Next, unlike many other companies, is well able to support its current bond and bank loans:

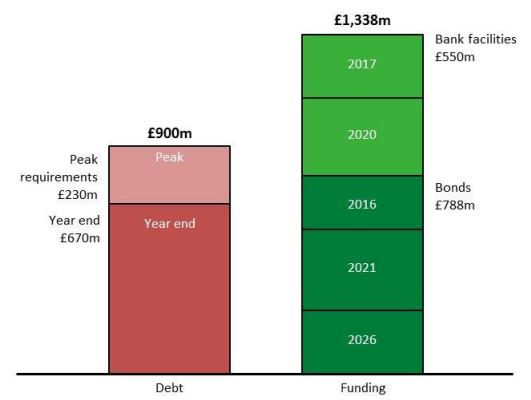

Such a high level of financial security is rather handy as this year the board forecast a negative cash flow of around £155mn; if they shell out £341mn in special dividends as planned. Behind this unpleasant outcome stands a one-off increase in the Directory debtor book of £200mn as a result of the before mentioned changes to credit terms. As is usually the case in reports from Next the logic of temporarily increasing debt, set against their high quality debtor book, is explained and the company has ample headroom in its borrowing facilities. So I'm comfortable with both the temporary reversal in cash-flow and debt hike at this point:

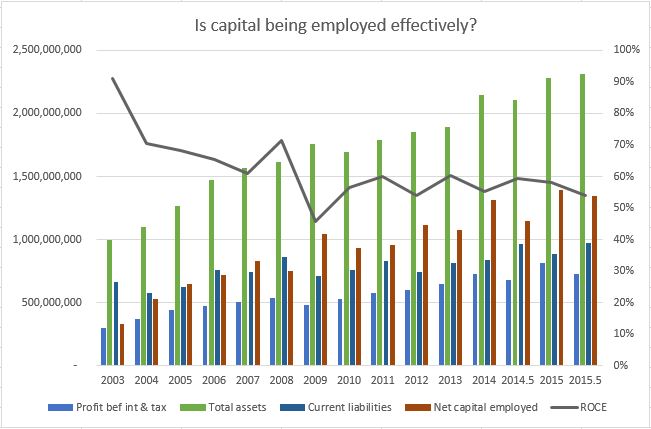

The final aspect of Next that I've long admired is its tremendous discipline with regard to capital and the high return, 50-60%, made on this capital. In fact to test how good this is I've just run a screen on Stockopedia selecting for shares with a 5-year average ROCE above 50% and a current ROCE above 50% and this returns just 17 companies with Next being the largest. The only other heavyweight (over £10bn in size) is Relx (the old Reed Elsevier) and I might just take a closer look there; otherwise 10 of the 17 are smaller than £500mn and some are real tiddlers. So Next is an outlier and looking at the growth in assets (and management of these versus liabilities) it doesn't look like the party is about to end:

Conclusion

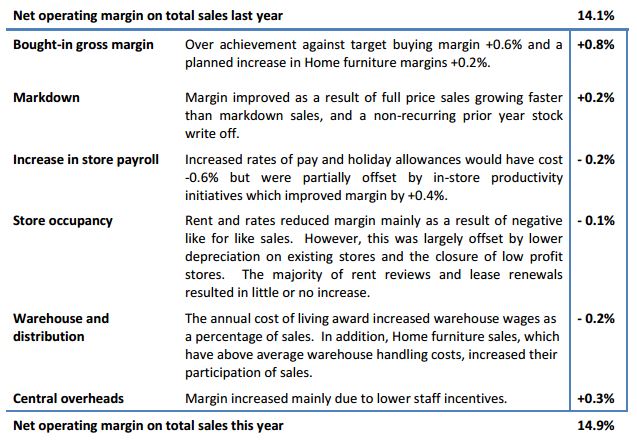

This is the tale of an exceptional business sticking to the basics while also expanding the division which generates the most profit. Much of this is down to effective cost control, driven by incremental efficiency improvements across the board, and targeted headcount reductions. In the half-year narrative much of this is made clear and in the 2014 annual report we don't even get to the statutory results until page 80 such is the volume of explanation! When set out so transparently it's obvious just how simple a business Next is but of course the devil is in the detail and implementation; areas where Next stands ahead of many other general retailers (with the probable exception of John Lewis). In some respects a detailed breakdown of profitability and margin drivers, like the one below, demonstrates how poorly other managers must understand their business if they can't or won't provide such detail.

The outcome of all this is that last we heard management ended up sticking to their previous profit forecast: We are maintaining our sales guidance for the full year issued with our trading statement at the end of July. NEXT Brand full price sales for the full year are expected to be up between +3.5% to +6.0%. This implies that sales in the second half will be up between +3.5% to +7.5%. At first sight guidance for the second half might appear optimistic, given that we only achieved full price sales growth of +3.5% in the first half. However last year was unusually strong in the first half and much weaker in the second half, with sales in September, October and early November adversely affected by unusually warm weather. That said a guidance statement for the third quarter is due on 28th October and so we'll soon see how accurate these predictions are.

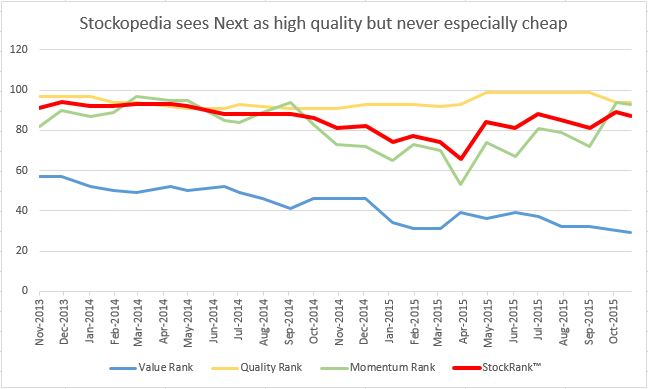

In the meantime it's clear that the Stockopedia computers have long held Next in high esteem with both the Quality and Momentum rankings remaining high for long periods. Shares with these characteristics are known as high-flyers and there's no doubt that Next deserves this approbation. Still the rankings have weakened over the last year and only now are they starting to catch up with themselves:

Finally it's clear that Next won't be engaging in any more share buy-backs for a while given their stated price threshold of £69.62; some 12.5% below the closing share price today. In my view this is rather positive as it liberates the board to continue returning excess cash to us, the business owners, and I see this as a superior mechanism for returning value (beyond share price appreciation). Long may this trend continue!

Disclosure: the author holds shares in this company