This successful and durable retailer comes with a high price tag and while its track record is impressive I think that it's best to hold off until a bargain price is offered.

Introduction

NEXT is surely a familiar and recognisable brand to most people in the UK; whether through its retail stores or via the popular NEXT Directory. This is no surprise given that the retailer has been around, in one form or another, for 150 years come 2014. Happy birthday!

The key to NEXT's success is that it offers an aspirational yet affordable brand with a premium image. A tricky act to pull off but one which the company makes its own. In 1988 the company branched out with the NEXT Directory, in a bid to revolutionise home shopping, and struck gold. Apparently there are currently over 3 million active Directory customers and I imagine that they eagerly await each new edition.

Sensibly NEXT remains largely a UK operation (90% of turnover is generated in this region) and given the shocking international failures of Tesco and Marks & Spencer I think that this is a wise decision. Then again the company did burn a few million pounds back in the 1990s when opening some trial stores in the US. Apparently a lesson well learned!

Full year accounts for 2013

There are many good reasons to like NEXT but from an investment perspective their commitment to clear and uncomplicated financial reporting is a breath of fresh air. Regulatory statements are produced promptly and yet still manage to provide actionable figures and unambiguous guidance on current forecasts. Why aren't more companies this helpful?

The latest annual report is a case in point. In the first few pages the most important figures (turnover, profit and dividends) are highlighted along with a clear indication that returning profits to shareholders is an explicit focus. There isn't a chest-beating biography of any director here; just a summary of objectives to help the company serve its customers and owners effectively.

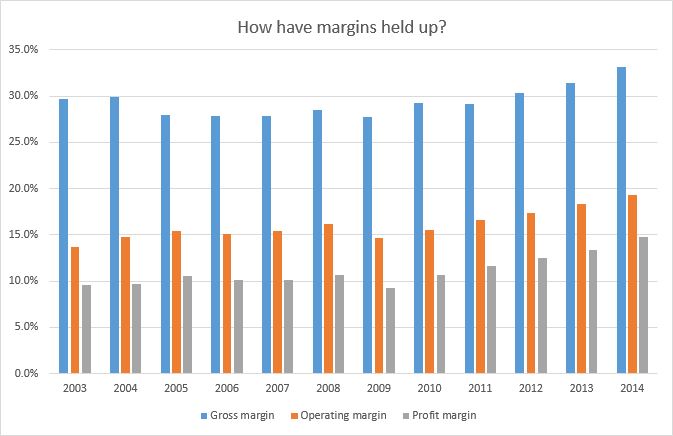

Looking at the figures over the last decade it's obvious that NEXT's growth record is excellent; managing not only to maintain margins but to increase them year-on-year. The business escaped the financial crisis largely unscathed and continues to evolve as a lean, mean profit machine:

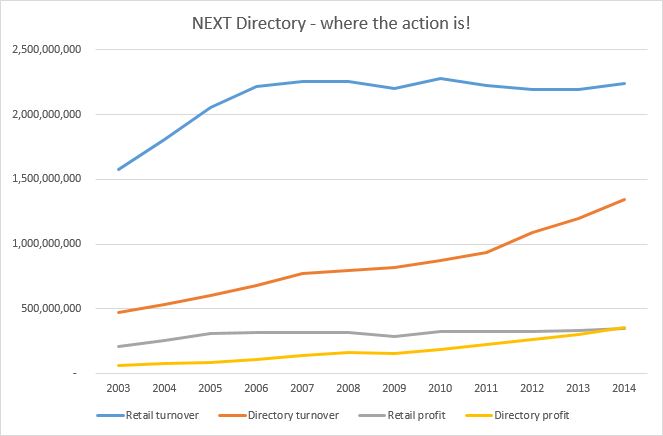

However hidden behind these results is something of a sea-change for NEXT over the last ten years. A decade ago the retail operation generated the bulk of the turnover and three times the profits of NEXT Directory. Last year, for the first time, home/online sales occasioned more profit than the high street; drilling in demonstrates just how becalmed the retail operation is:

This is not necessarily a negative development as stores are expensive to staff and maintain while the margins from home and online sales are almost twice those from retail. In lock-step with this shift the overall headcount has been shrinking slowly for a number of years now and capex is less than depreciation in both the retail and directory divisions. So NEXT is actively curtailing less profitable business.

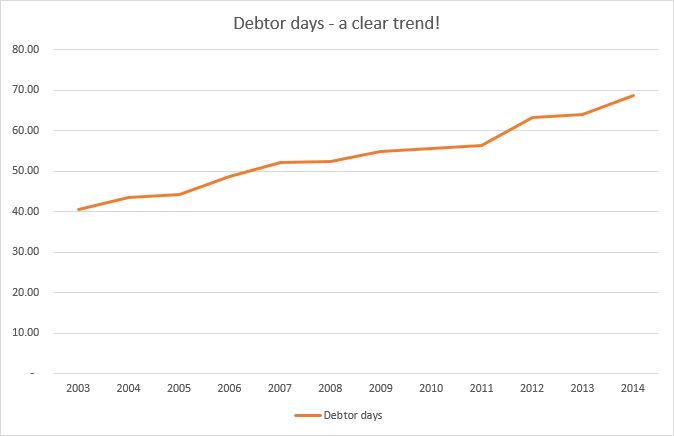

On the other hand this re-orientation towards NEXT Directory potentially explains the most insidious trend of the NEXT accounts: since 2003 debtor days have risen every single year from a reasonable 40 days to over 68 days:

This is a concern as it suggests that NEXT Directory revenue growth is being driven by a relaxation in payment terms and often concomitant with this approach is a worsening bad debt load. That said while a doubtful debt breakdown has only been published for the last 5 years or so the default rate remains flat at about 1% and the amounts written off as uncollectible are static at about £25M per annum. So while NEXT are inflating their exposure to customer receivables they are, at least, collecting on these accounts (unlike some foreign companies I could mention!).

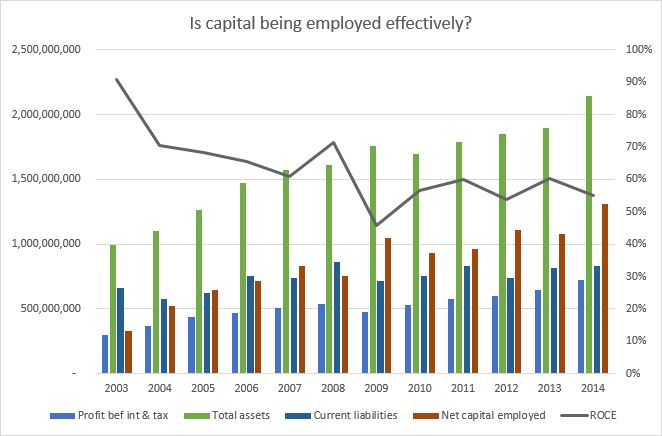

Looking at the capital side of the business, and how it uses debt, it's clear that the corporate bond market is a favourite for leverage purposes. As things stand there are £800M of bonds outstanding, and nil bank debt, with a big tranche due for repayment in 2016. This is clearly of no concern though, with three special dividends paid out this year already, and this ease is backed up by cash in the bank and very healthy interest coverage.

When it comes to using this capital NEXT has an exemplary ROCE record, averaging 45-60% over the last five years. True this level isn't quite up to the watermark of 10 years ago but it's still pretty remarkable for a ten billion pound enterprise:

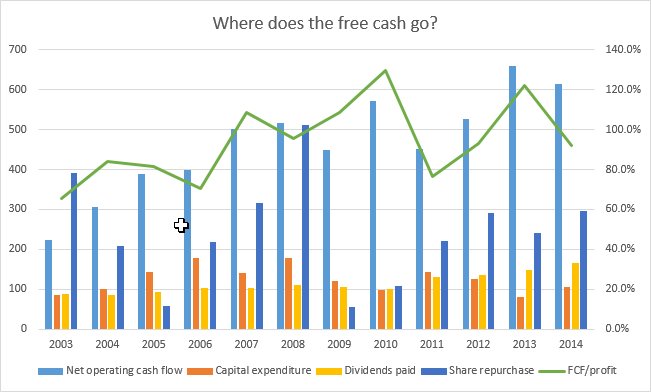

From a cash-flow perspective the reported numbers look equally impressive. Almost every year more than 100% of the reported operating profit converts into cash-flow but what's perhaps more impressive is just how much free cash-flow is left after capital expenditure. There's just so much cash being generated that the company can handle share buy-backs that dwarf any other discretionary expenditure:

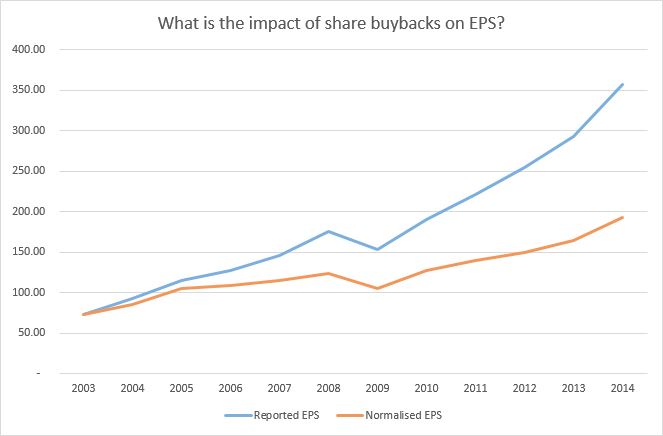

The final area that interests me with NEXT is that of share buybacks and how they've driven shareholder returns for a number of years. Since 2003 the company has managed to almost halve the number of outstanding shares and this has inevitably boosted any share count related metric - most plainly the reported earnings per share - above and beyond the impact of organic growth.

For example I've performed a rough and ready assessment of the consequence by taking the actual EPS figures and comparing them to the EPS which would have been reported had the share count remained static and cash been returned as dividends instead. In these simple terms the headline EPS is not far off double what it might have been otherwise:

From this report, and others going back to 2003, it's abundantly clear that NEXT is a quality business generating excellent returns for its shareholders. It's reporting is a model of clarity and I can't find any material gremlins hiding between the lines. Even on the pension front the company is impressive in that their final salary scheme is long closed and they're working to transfer the liabilities to an insurance company.

What's the latest news?

With the half-year results in July the company reports pretty much business as usual with a very strong first-half. Profits in all areas surged upwards with retail performing especially staunchly.

However in the past few months trade has been unexpectedly soft with the wrong weather at the wrong time. Like most clothing retailers the company benefits from cool conditions and this warm October has done them no favours. As a result profit expectations have been scaled back from those of the mid-year (although still an increase on the forecast range back at the start of the year).

It's possible that sales will recover over the next few months, and especially over Christmas, but nothing is guaranteed. Hence the recent weakness in share price; it's almost down to a level where the company is prepared to fund yet more share buybacks. I can see how this might provide a floor under the price.

Conclusion

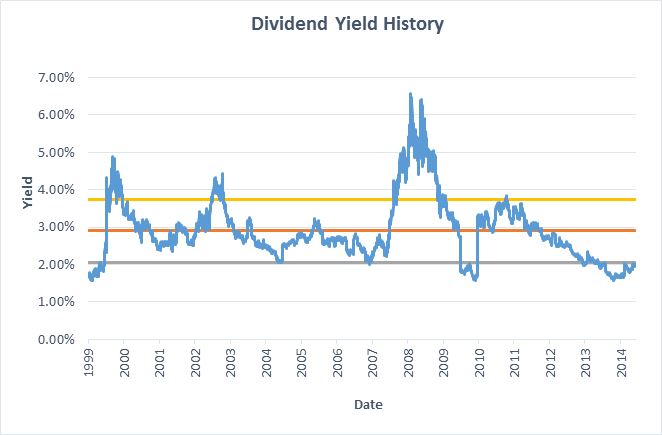

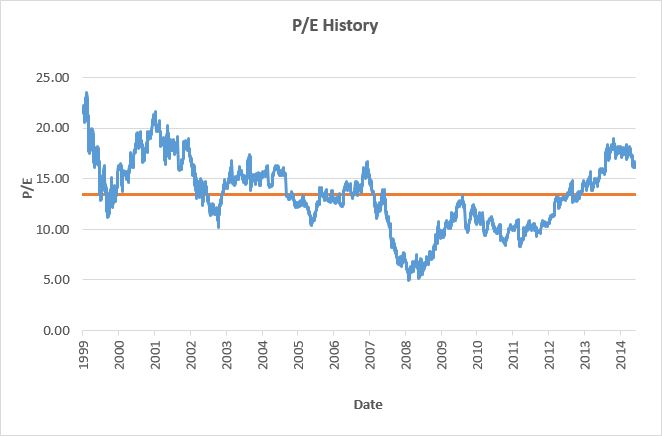

My biggest problem with NEXT is that I wish that I'd splashed out on it in 2008! Back then, in the teeth of the crisis, you could pick it up at a P/E ratio a shade over 5 and a yield decently in excess of 6%. A rare opportunity indeed as over the last 15 years the average yield is 2.9% and the average P/E is 13.44:

Right now though the yield on offer is a stingy 2% and the P/E is in excess of 16 - despite a 10% drop in share price since September and the solid (rather than spectacular) profit forecasts being made for the next couple of years.

The only bright spot, from a valuation perspective, is that NEXT plan to pay out 150p in ordinary dividends this year (a yield of 2.3%) and they managed to dish out the same amount in special dividends over a six-month period this year. So it's possible that there's more to come; the board publicly state that they are likely to pay special dividends on a quarterly basis when the share price is too high for them to consider buybacks.

So I find myself with something of a dilemma. If the price remains high then there will be further special dividends - the company generates far more cash than it can invest profitably and has no interest in leaving this in the bank - and the yield will be above 4%. Alternatively if the price drops then it'll be share buybacks all of the way and that's less directly attractive to me. So I'm not tempted to put my hand in my pocket unless the share price lurches south and if it does then I won't feel the impact of any shareholder returns so distinctly.

Decisions, decisions.

As a side note this academic paper from the University of Aberdeen Business School looked in depth at the company being a takeover target for H&M. As it happens the author suggests that NEXT should be preferred over Ted Baker and the data support this assertion; a missed opportunity for H&M perhaps? At least I'm in good company!

Disclosure: the author holds no shares in this company.