TL;DR:

Palace Capital is a young but fast-growing company specialising in neglected regional property portfolios and while the management have performed in an exemplary fashion so has the share price.

Introduction

Palace Capital is a company flying under the radar of most investors. With its sub-£100M market cap, short life on AIM, very recent move towards profitability and concentrated portfolio of regional assets this stealth is not a surprise. The company is, however, becoming appreciated by a wider audience as it continues to acquire assets.

In a nutshell this is a vehicle for a small team of very experienced property investors with specified strengths: "Our particular skill is with properties which have early lease expiries or break clauses and managing them to become better and more secure investments. We have recently concluded three transactions after our financial year end which will be earnings and value enhancing."

For a little more colour this is a rather nice piece (from Dec 2013) by Neil Sinclair on regional property and venturing early into the upswing: http://www.palacecapitalplc.com/palacecapital_pdf/PCA%20-%20Estates%20Gazette%20-%2014th%20December%202013.pdf

A brief history

In the beginning was Leo Insurance Services; a shell that failed to invest successfully in the insurance sector. All the company had going for it was a listing on AIM and solvency. Then along came Neil Sinclair, Stanley Davis and Andrew Perloff with a little bit of capital and a big idea to invest in property. Now Perloff I've heard of as the irascible chairman of Panther Securities, a property company in its own right, but it turns out that Neil Sinclair is also a veteran real estate man. So they bring a vast amount of experience to the table and perhaps a fair splash of hope.

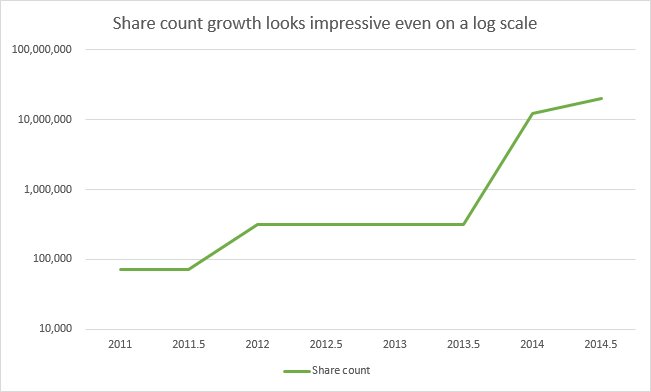

Over the past four years three key transactions have turned Palace Capital from a sub-£1M shell into a profitable, dividend paying company with the potential to reach a £100M market cap. First up was the acquisition of Hockenhull Estates, a group of properties in Cheshire, for £1.8M. A pretty titchy transaction but even this stretched the company to the limit; in order to fund the purchase the directors had to borrow £1.2M, quadruple the share count to pull in £500K and pitch in almost £600K of their own money! So both a brave step and a pretty strong sign of conviction although the placing did take place at a massive discount; 225p relative to a share price of 450p!

Two years later the board announced a far more audacious move with the purchase of the Sequel Portfolio from Quintain Estates for a tidy £39M. Once again funding coalesced from different sources with £23.5M via a placing, £20M in bank debt and further director loans. On the other hand the placing, a huge jump of 20x, sold at only a small discount to the share price (200p compared to a price of 212.5p) which is pretty impressive. What's also interesting is that QED didn't crow about how they'd managed to off-load this portfolio at an excellent valuation; it truly looks like it was a non-core operation (being outside London) and also loss-making to the tune of £11M per annum. So an excellent purchase.

Then last year the company went for Property Investment Holdings Limited in another large acquisition of a distressed portfolio valued at £32M. Again a placing, for £20M, covered a large chunk of the costs with bank debt covering the rest. Usefully the new shares were priced at 310p and a mere 6.8% discount to the share price. Also the directors invested heavily into the placing to more or less maintain their holding levels in the firm.

Of course they didn't have much choice unless they wanted to find themselves diluted out of existence:

Looking across these transactions what's very clear is that:

- The board are serious and choosy when it comes to acquisitions and are prepared to wait for the right commercial opportunity

- When a previously unloved portfolio is taken on-board then the directors have both the experience and focus to markedly improve the new assets

- The directors are prepared to take on large portfolios relative to the size of the company even at the expense of diluting their own holdings

- This expansion has allowed a number of institutions to join the share register and as a result the share price has remained resilient to large placings

- Historical results are of little use due to these repeated transformational deals and there is still a lot of reasonable expectation in the share price

Now while it's fair to say that the early results are of little use in valuing Palace Capital, given that they are unremittingly loss-making, we do at least have the last year to consider. In this time good progress has been made on letting out empty space and working towards conversion of a large office building in York to residential units. Real rental income has also flowed from the Sequel portfolio; sufficient to cover interest payments by 3x or so and imply an after-tax profit margin of 30-40%.

From a balance sheet perspective the conservative level of gearing, at 40-50%, speaks well of management and their attitude to risk. The debt load is very clearly assigned to lenders and shareholders alike and there seems little risk to the company from this quarter in the current low-interest rate environment. Additionally the firm has spare cash in the bank and current liabilities are very well covered by current assets (the ratio is an excellent 340%).

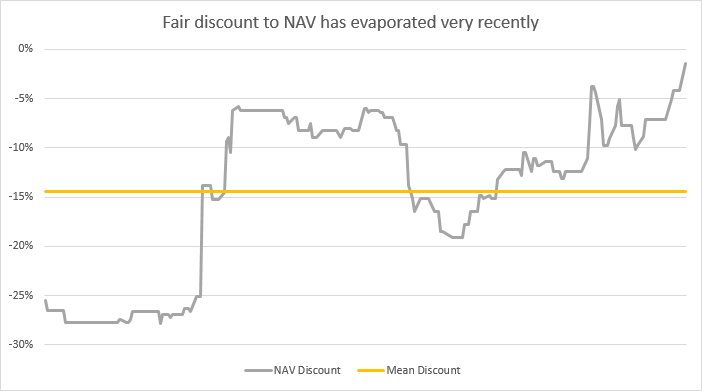

That said while the company is in good shape the NAV discount over the last year, as representative a period as any, has narrowed massively and is at its smallest value ever; in fact with gains over the last few days the discount has almost entirely vanished:

From a funding perspective this is great; if the company requires another large share pricing then they should be able to get it away at an excellent price and avoid diluting the NAV! If you're a prospective shareholder though then this recent strength is a pain as it makes the shares rather expensive on paper!

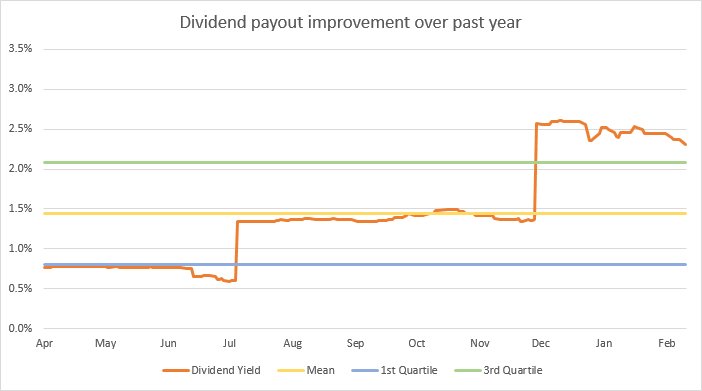

A further positive sign is that the company began paying a dividend last year, as promised when performing the Sequel acquisition, and have every intention of increasing this quite substantially: In the Company’s Admission Document dated 2 October 2013 the Board stated its intention to recommend a dividend of 12p per share in respect of the period ending 31 March 2015. It is our intention to pay a progressive dividend and we will consider the level of a final dividend at the time of the year-end announcement, taking into account our previous statements, progress on lettings, further investment in our existing portfolio as well as new acquisition opportunities:

Right now, with the share price at 368.5p, this promised 12p equates to a yield of 3.3%. Pretty decent compared to most of the firms in the real estate sector although, amusingly enough, lower than the yield on Panther Securities. There must be some reason why Andrew Perloff has been so quiet with Palace Capital!

Conclusion

There's little doubt that the directors of Palace Capital have acquitted themselves admirably in a very short space of time. In the beginning it all looked pretty speculative, with a high dependence on the directors for financial support, but real profits have come quickly.

Of course there is a certain amount of risk inherent with such a concentrated board (one exec and two NEDs) and there have been quite a few related party transactions with fees being paid to companies owned by Stanley Davis and Richard Starr. It's only sensible to wonder whether the company is being run for their benefit and if these transactions were put to competitive tender? On the other hand the board members took low, or no salary, in a number of years, while the company grew, and have a lot of skin in the game.

An aspect of the immaturity of Palace Capital is the fact that it isn't a REIT, which is fine, and doesn't report like one, which is less fine. So the reporting is brief and doesn't provide EPRA figures or a breakdown of property income and expenses. Early on this didn't make much difference, as there was so little revaluation activity, but things have heated up on this front lately. The upshot is that the reported profit figures include revaluation gains and so are somewhat illusory.

If you subtract revaluation gains then the EPS for 2013/14 came to 13.9p with the first half of 2014 pushing on to 11.3p. This may be where the broker forecasts of about 22p for the full year come from but I have to say that this feels conservative. In fact from reading the narrative in the last interim results it's clear that the board are intensely active in reducing vacancies, negotiating with tenants and exploring development opportunities. So I can see earnings coming in at around 25p (excluding revaluation gains) due to the Sequel portfolio already bringing in more rent in 6 months than in the previous 14 months!

That said the real driver of shareholder returns with Palace Capital will remain revaluation growth. There's no doubt that the excellent progress made so far will continue, with this being down to management actions rather than market advancement in the short term, but I can't help feeling that this, and more, is now baked into the current share price with the NAV discount all but wiped out. So I'm happy to let some of the froth die back and to see what upside surprise emerges with the full-year results in June.

Disclosure: the author holds no shares in this company