A poster child for the perils of private equity Somero demonstrates how a cyclic, construction-sector supplier can profit when run by experienced, cost-sensitive management.

Introduction

While Somero is far from a household name it's likely that we've all benefited from its products - machines that guarantee a totally flat concrete floor for non-residential customers. This might not sound like a big deal, unless you're employed in the concrete laying business, but apparently clients derive long-term benefits from such accuracy. Even better Somero is the undisputed global leader in this niche market, which it essentially created, and has been for the last 30 years.

A downside to this laser-like focus is that the fortunes of the company are closely tied to the health of the global economy; in 2009 demand for Somero's machines fell off a cliff and it took four hard years for earnings to recover. During this period the company came as close to insolvency as you can and still survive; only an emergency injection of capital along with bank covenant relaxation plus deep staff and wage cuts allowed the business to survive.

Now recent share price action has reflected this recovery, and perhaps more than that, by leaping from a nadir of 10p in late 2011 to around 142p today. The big question, in my mind, is whether Somero still offers decent value, even now, or whether the easy gains have been made and the company is at the top of its cycle and poised for another fall.

Analysis

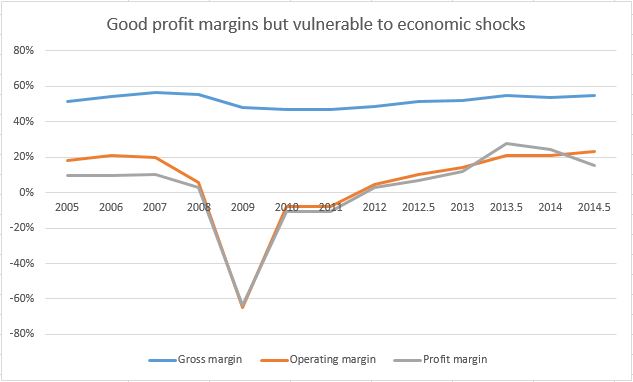

A key element of Somero's attraction is that it's a global leader in its niche of ultra-flat concrete flooring and as such is in a position to command high profit margins. At the gross profit level this theory is borne out with a margin of around 50% being achieved even during the downturn. In contrast profits after non-production costs have been considerably more volatile but with solid progress in recent years; in rebounding from 2009-11 the profit margin has accelerated past a pre-recession level of circa 10% to hit 15% as a result of both general business recovery and reduced drag from debt servicing costs.

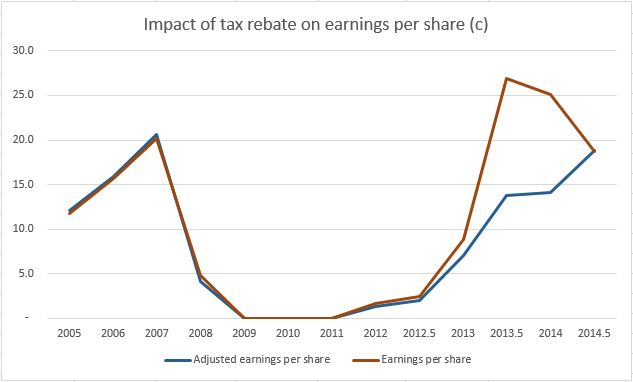

A slight wrinkle in the data is that profit margins appear to be trending lower after a bumper 2014 - which ties in with an EPS of 25c being reported last year versus the current year forecast for 21c. The reason for this is that last year benefited from one-off deferred tax assets, and thus super-normal profits, while in the latest interim results the tax rate has reverted to the federal statutory rate of 34%. So I've adjusted for this skew by working out how profits would have looked if this flat rate had been paid in every year since 2005 and the outcome is that in 2014 earnings per share (EPS) would have been 14c while this year we're looking at 20c or more.

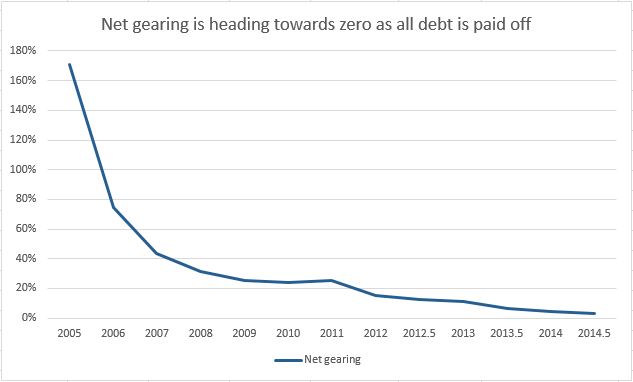

So I'm confident that underlying earnings, and profit margins, have more than recovered from the global recession. The key upside from this is that Somero have managed to re-pay all of the roughly £16M in debt that their previous private equity owners (The Gores Group) lumbered them with before flotation in 2006 (a quick flip having acquired them in 2005). Some of this was paid back immediately on going public but the rest has been chipped away over the years with gearing dropping from an unhealthy 170% to near zero:

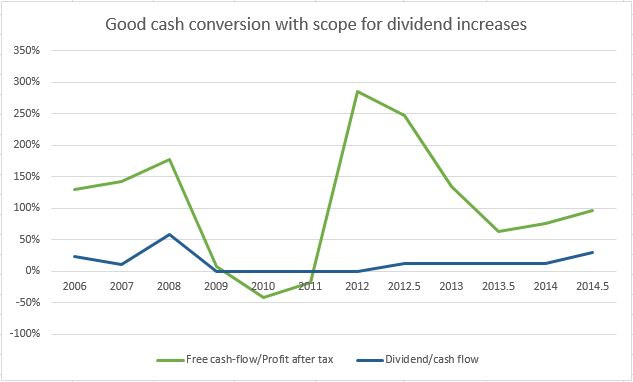

The driver for this repayment has, on the whole, been excellent and sustained conversion of profits into cash. Apart from an emergency capital raise in mid-2009, to reduce bank debt, the company has generated all cash internally from organic growth. With sensible, but not excessive levels of capital expenditure, the cash conversion ratio is high (anything near 100% is what we're looking for) - especially so in the downturn when receivables unwound directly into cash as new business choked off:

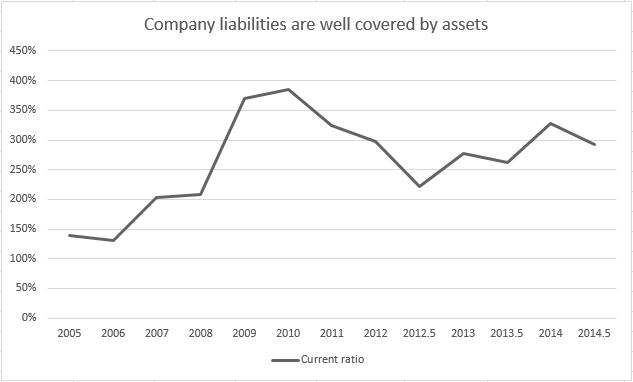

A related dimension to this is that Somero has excellent liquidity characteristics; the current ratio, which is the balance of current assets to current liabilities, is near on 300% and has been high for the last decade. Given that anything above 150% represents a prudent balance sheet then the company is bullet-proof in this regard. In fact even if all other assets (such as stock and invoiced but not received accounts) are ignored the firm has enough cash to cover its current liabilities. This is a very good place to be.

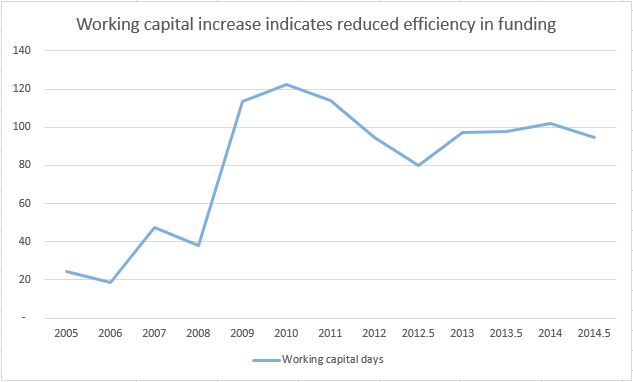

On the other hand it can be argued that strong as the balance sheet is it is also rather inefficient as the company isn't sweating its assets very hard. Certainly in the early years Somero operated with a fairly low level of working capital compared to sales and turned it over every 20 days or so. During the recession though working capital tripled while sales halved with the result that the turnover time jumped to around 100 days (i.e. working capital turns over 3 or 4 times a year) and has remained elevated:

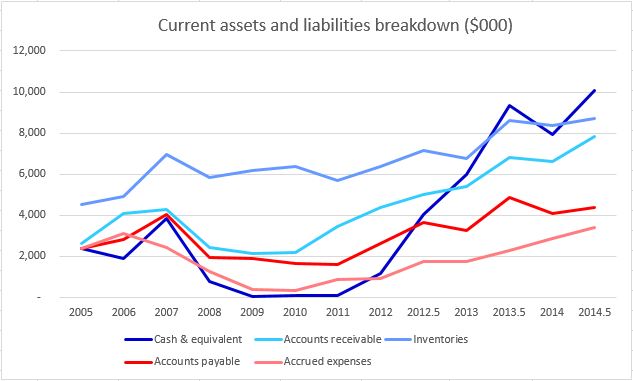

I must admit that this change in working capital position does somewhat concern me as inflation here can indicate debtors increasing faster than sales or inventories of unwanted stock piling up in a warehouse. So I've drilled into the numbers and there are a couple of factors at play here - both of which are suggestive of a more-risk adverse management (which makes sense given past history). On one hand ready cash bottomed out at essentially zero in 2009-11 but since then it has mushroomed to outstrip current liabilities and near enough match all liabilities on the balance sheet!

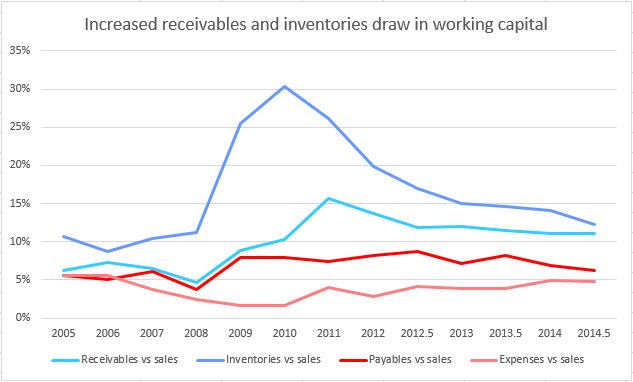

On the other more inventory now sits on the balance sheet (12-15% of turnover compared to 10% in 2005/06) and receivables are up at 11% compared to 6-7% back then; so there's more stock, possibly because there are more product lines, and customers are taking longer to pay their bills. That said the inventory did reach 30% of turnover back in the dark days of 2010 so things have improved on this front! At the same time liabilities such as account payables and expenses have fluctuated more in line with sales and thus a working capital gap has opened up. I don't think that any skeletons are being hidden here but Somero probably does have a 'new normal' when it comes to funding the business:

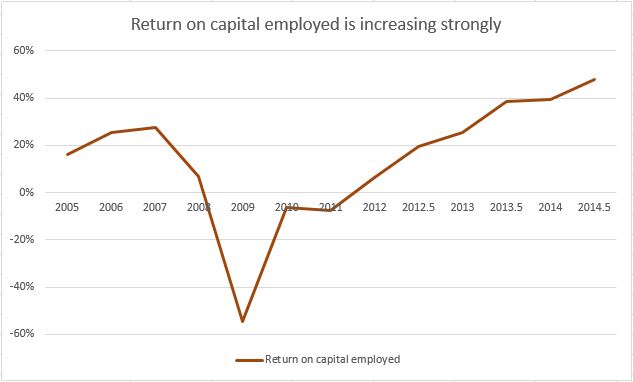

Talking about reaching new levels though a metric that's looking very strong for Somero is its return on capital employed (ROCE). A value over 20% is very good indeed, if sustained, and the company managed that in 2005-08 despite having a balance sheet stuffed with intangible assets (a legacy of the private equity takeover). However these were heavily written down in 2009 and the balance sheet is now much slimmer while profits are markedly higher - so much so that ROCE rose to 48% in the last interim results. Very impressive!

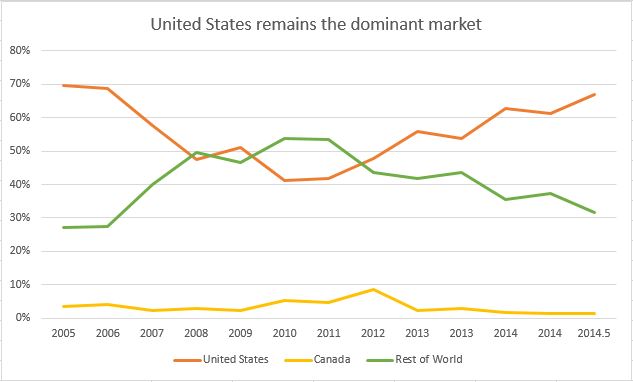

The final aspect of Somero that I'm going to consider is where it generates its sales, how diversified it is and whether there's an opportunity to insulate itself from volatile capital budgets. From a geographic perspective the board have long indicated that they see China and India, amongst places other than the US, as vast untapped markets and have a laudable goal of reducing their dependence on the States. Unfortunately, so far, they have signally failed to deliver on this promise and the home market remains as much a driver of company profits as it ever was:

In 2005, when our story begins, local sales accounted for 69.5% of turnover and yet in the latest results we can see that this fraction remains high at 66.9%. So no real change and while in 2010 the split had diminished to just 41.2% this was only because the US business collapsed much more sharply than in any other market. Hardly an achievement for the executive team and nothing to crow about (which is exactly how it got reported). This is a rather disappointing outcome given the continuous, ongoing investment in overseas markets. Perhaps we just need a tipping point for it all to work out but right now the numbers suggest that the company has a long way to go.

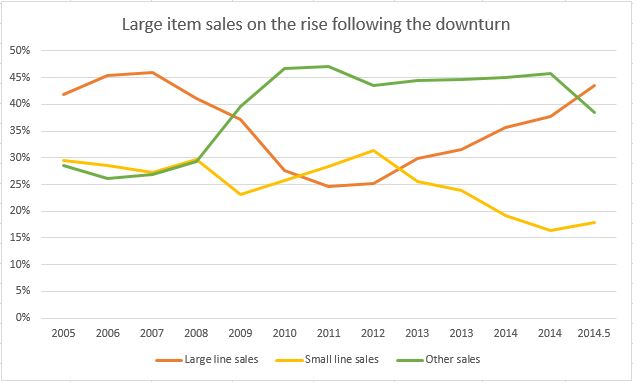

From a different angle Somero is very dependent on concrete contractors shelling out big bucks for their machines in the hope that they'll land juicy contracts with very exacting flooring specifications. The problem with this business model is that purchases dry up when times are tough and without a separate, recurring revenue stream there's nowhere to turn. As it happens the company does have an other source of sales that includes spare parts, refurbished machines, topping spreaders and accessories; the problem is that these sales (which became very important during the downturn) are being overtaken by sales of large machines. This is fine for current profits but Somero are no closer to smoothing the economic cycle than they ever were.

Prospects

Somero has clearly been on a tear for the last three years, as the global economy has stabilised and pent-up demand released, and statements in the current year suggest that momentum continues. Back in January the end-of-year trading update spoke of strength across all products and regions:

Demand has continued to be strong across our core existing product range whilst new products have contributed significantly. We have also seen a broad geographic base to our growth, with H2 2014 top line growth driven by sales in North America, China, South East Asia, Latin and South America and Europe.

I also like the fact that management are making good use of the growing cash pile by expanding the business to meet projected demand:

Due to the anticipated growth of the business in the medium term, the Board has concluded that the current Global Headquarters in Fort Myers will not be large enough to accommodate future growth. As a result, the Company has entered into an agreement to purchase land to build a new Global Headquarters at an expected cost of up to US$ 4.0m spread over 2015 and 2016.

However the AGM statement in May presented a slightly less rosy picture with demand falling in China (despite investment in a training facility, assistance with financing for contractors and the company's five-year strategic plan):

With respect to China, which currently represents a small proportion of the group's revenues, 2015 started slower than expected. However, we are now beginning to see positive momentum in job mobilizations, giving confidence that the construction season is underway and we expect to continue to see increased demand in the medium-term with the region well into its fifth consecutive year of strong sustainable growth.

So a rather more pessimistic statement then expected with the result being that a number of large institutional holders reduced their exposure in May and June. That said maybe it's just a temporary blip if this AGM report is correct? The last trading update in July certainly backs this thesis up:

In China, activity levels increased in May and June from the slower than expected start to the year highlighted in our previous announcement, and we are seeing healthy momentum in demand for our products.

Finally the interim results were released just a month ago and the key takeaway here is that the US market is healthy and growing with new products really paying off:

US sales momentum has carried forward into 2015 as a result of our new product introductions, such as the S-485, replacement demands on outdated technology, ongoing construction growth and project backlogs our customers are experiencing. This growth trajectory is expected to result in strong sales for 2015.

Elsewhere Europe, South America and the Middle East are poised for decent growth despite areas of weakness such as Russia, India and Brazil. However China remains a disappointment and I sense that this really burns management given how this region is given the longest paragraph by far in the statement:

However, China started the year slowly, resulting in trading in H1 2015 down in comparison to H1 2014. Somero continues to progress in developing brand awareness, providing education and training on the value of high-performance flat concrete floors, and finalizing third-party equipment financing options through the Bank of China. Our low penetration rate in China, combined with greater acceptance of flatness standards and customer willingness to use our products and services, indicates Somero has ample opportunity for growth going forward. In addition, we expect the planned launch of the Concrete College in Shanghai in Q4 2015 will play a key role to support growth in the region.

There's no doubt in my mind that management are betting heavily on China and they probably should given that it has the potential to be the second-biggest market after the US (and worth more than all other non-US customers combined). But it's a risk given the well-publicised slowdown in China and I'm glad that these other non-US customers have perked up this year!

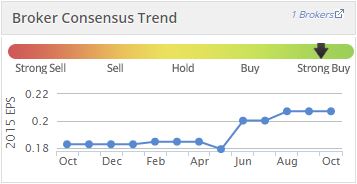

I also like the fact that management are continuing to invest in new product development and in expansion of their facilities. This is a sensible use of cash and should fuel the sort of organic growth that we're looking for. On this front analyst forecasts for the current year jumped from 18c to 21c in the summer (a 15% rise) and this looks quite achievable with just under 10c in the bag so far. If they hit this target, and nothing so far suggests that they won't, then that'll be a 50% rise on 2014 (if adjusted for the tax rebate) and the highest EPS Somero has ever achieved.

Conclusion

I saw Jack Cooney (CEO) and John Yuncza (CFO) present at a recent Sharesoc Growth Seminar in London and found them to be fronting the most impressive company on show for a number of reasons. On one hand Jack provided a clear summary of how and where Somero operates and didn't prevaricate on the level of slowdown seen in China. At the end he also, quite happily, answered a number of difficult questions from investors on where the company has strengths and weaknesses. John, a recent hire, focused purely on the numbers and specifically on how excellent cash-flow has allowed the company to become cash-positive for the first time in years. On face-value then both executives appear to have the operating expertise required without coming across as salesmen.

In terms of questions put to the CEO these principally focused on the company's lumpy revenue stream and exposure to the next economic downturn. Jack freely admitted that Somero is all about selling the machines and, as such, has limited recurring revenue streams. They have considered ways to alleviate this, such as working through hire companies, but this has come to naught as it conflicts with the USP of Somero - which is that they are differentiated by their worldwide training and support network. Anything that causes them to lose contact with an end-user interferes with this and may well make their machines perform poorly in the field (due to operator problems). So their answer to these concerns is to diversify globally, continue to invest in innovation and education and to create a strong balance sheet.

I do like this constant and repeated focus on customer care, product innovation, cost minimisation and debt reduction. Management really do seem on the ball when it comes to controlling all that they can control; the biggest problem with Somero is that there are plenty of factors which they can't influence and yet are big enough to sink the company. That said the company is financially sound, geographically diversified and innovating for future growth. In a less cyclical sector I'd pay a good price for such qualities!

So I think that these are the key arguments for and against investing in Somero:

Pros:

- Excellent cash conversion from profits

- No current debt and managed to reduce prior debt even through the downturn

- Very experienced management

- World class product which is actually used worldwide

- Excellent reputation in market place with brand recognition

- Demonstrable history of innovation

- Reasonably cheap by standard measures

- High margins due to dominance in niche market with pricing power

- Clearly written reports and regular trading statements

- In business for almost 30 years and successfully so

- Competition mainly from low-tech or manual methods of screeding

- Prompt reaction to last recession with a sharp focus on costs

- Close relationships with customers allow for response to feedback

- Maintained key R&D during recession to prepare for future

- Consistent strategy message from directors

- Could easily be a takeover target with current management

- Has a 5-year growth plan up to 2018 with revenue doubling targets

Cons:

- Extremely cyclical and geared to construction industry

- Little in the way of recurring revenue

- High dependency on US economy and this remains the case

- Management will retire soon in all likelihood

- Unclear where the recent problems in China originated

- Product is not essential - it has to be sold to clients through education

- Customers are contractors and so don't specify the end-user requirements

- Two customers account for 46% of accounts receivable

- Almost went under during the last recession as alluded to in report

- Hasn't been a great long-term investment from the float price of £1.25

- Listed on a foreign exchange for nebulous reasons

- Jack Cooney has been CEO since 1997

All in all I find Somero to be exactly the type of company that I like to invest in; it provides products which add value, the margins on these products are generous and so is cash generation, management are both experienced and honest and the enterprise isn't being used as some form of acquisition engine with all of the financial engineering that that can imply. The only downside is that profits will crater when the US next enters a recession and so will the share price!

Disclaimer: the author holds shares in this company.