It's with a sigh of relief that I write these words on the first day of 2021. I'm hardly alone in being glad to see the back of 2020 but I really am glad. With a hard Brexit avoided at the last minute, a relatively sane president-elect in the USA and Covid-19 on the verge of being vanquished by vaccination it feels as though we've dodged multiple bullets. With luck this new year will be one of consolidation and recovery. The economic repercussions of the pandemic are yet to play out but I suspect that animal passions will run high when lockdowns are finally lifted around the globe. This may well unleash a wave of suppressed desire to enjoy life and take risks. It won't be the 1920s all over again but there may well be echoes of that golden age. I'm looking forward to brushing off my fedora and breaking out the spats.

Looking back at December a number of my holdings rose more than 20% but DX Group took off like a scalded cat with a 43% rise. I think that a combination of director purchasing and positive statements has finally bought the company to wider attention. Sadly I dallied too long in considering a top-up at around 28p as the price then jumped another 25%. At the same time new holding Calnex Solutions moved up 32% as investors learnt more about this new listing and its exposure to the 5G roll-out. Elsewhere the US markets helped me out by either engaging in a bidding war for Codemasters or re-recognising the merits of GAN as states approve legislation around real-money gambling and sports betting. Happy days for sure with very few of my holdings falling by any material amount. Right at the bottom we have Plus500 and Spectra Systems dropping by 7% on little more than an easing in investor sentiment.

Overall my portfolio was up a ridiculous 9.8% in the month (what a Santa rally!) taking me to 26.1% for 2020 as a whole. This is a touch below the ATH but frankly who's counting? It's a great result which completes an excellent four years where the unitised asset value of the portfolio has doubled (this is adjusted for inflows and outflows). I'm no investment genius but it's pretty clear to me that the motivated private investor can do a lot better then sticking their savings or pension pot into an institutional fund. It takes a bit of work, of course, but the results speak for themselves.

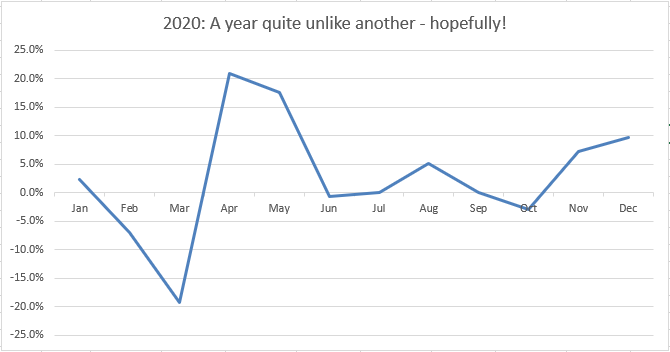

However the DIY approach does come with mark-to-market volatility which can be unnerving. Still the range in monthly returns is not usually quite as extreme as this year:

Risers: DX. 43%, CLX 32%, CDM 30%, GAN 22%, SCT 21%, VLX 17%, K3C 15%, SLP 14%, LUCE 14%, BOTB 13%, GAW 13%, CCC 10%, BOO 10%, TSTL 9%, TPFG 8%, AFX 5%, BLV 5%, CMCL 3%, GAMA 2%

Fallers: TAM -1%, LOOP -1%, DRV -2%, TM17 -2%, RWS -5%, BUR -5%, PLUS -7%, SPSY -7%

Purchases

Belvoir Group Bought at 154p - December 20

The recent trading update from Belvoir is remarkably good, as mentioned below. For the group to be doing better than predicted before the pandemic even started is a testament to all of the staff within the business. The implication of this is that 2020 will be the third year in a row where sales and profits have both grown by more than 20%. And yet, despite this, the shares are valued on a forward P/E of ~10. Part of the reason for this may be the low growth forecast for 2021 (just a few percent) but I am certain that the analyst predictions for 2020 and 2021 will shortly be increased by the house broker. Once this happens the shares should break through overhead resistance at 160p and could make their way back to the 180p level first reached in February. Meanwhile we'll receive a bumper dividend in the knowledge that Belvoir is trading well on all fronts.

Caledonia Mining Bought at 1245p - December 20

This has been a moderately frustrating investment in that the sinking gold price has utterly overwhelmed positive operational news flow. I can understand why this has happened, and why the shares have lost a third of their value since July, but it's still a bit trying. The fact is that we've had two strong quarterly production updates in the last six months along with key news regarding the completion and fit-out of the new Central Shaft. This is a game-changing development for Caledonia with it both doubling potential production while reducing the cost of production. That the company has managed to complete this development using internal staff and with no deaths (which is always a risk in mining) shows the quality of the on-site team. They've also handled the pandemic restrictions with resilience and appear well-versed in dealing with the Zimbabwe administration. As a result I've been looking for an opportunity to increase my holding. With the gold price starting to bounce, and the share price finding support at ~1300p, I figure that now is a good time to be brave. In January we'll receive an update on Q4 production and hopefully the news will be positive as the miners always seem to work hard in the final quarter. Perhaps this is because of their Christmas bonuses? Either way things are looking good and I'm happy to be patient.

Games Workshop Bought at 9990p - December 20

In fairly short order this purchase makes Games Workshop my third largest holding. There have been three very positive trading updates in quick succession and yet the share price has barely moved. I believe that this weakness is down to one of the larger institutional holders becoming a forced seller. As the price rises this will remain a headwind but eventually it will abate. In the meantime we're left with a company trading phenomenally well at an unusually suppressed valuation. I would buy more but I don't want to get too carried away.

Best Of The Best Bought at 1253p - December 20

The price action here has been downright disappointing in the last few months. The last trading update indicated that trading remained strong, which is reassuring, but didn't raise expectations. Still these do indicate earnings rising 86% this year which is a remarkable level of growth for a P/E of just 16-17. More perplexing is that the sales process remains ongoing with several parties still in the running. It's hard to believe that it's taking this long to go over the accounts. I think that the blocker is that management, who own the lion's share of the business, want a higher price than any buyer wants to pay. If this means that the sale collapses then so be it. I'm happy to continue holding such a profitable enterprise. On the other hand it's notable that a date for the H1 results announcement hasn't been published as this might indicate that an offer is imminent? As I see risk to the upside with Best Of The Best at this level I've increased my holding by 50%.

Tandem Group Bought at 490p - December 20

Tandem is a step outside my comfort zone with a market cap of just £25m and a 5% bid-offer spread to match. In the past it also had directors that failed to hide their disdain for the private investor. Still governance is starting to improve and Tandem has profited handsomely from the pandemic. At the same time a number of well-respected private investors have taken large positions in Tandem in the belief that the business is set for continued growth. The mood music here is certainly positive and with the price dropping just over 15% from its recent ATH I've taken an initial position. From here sentiment is likely to turn positive if an upbeat trading announcement emerges and will certainly go negative if Brexit blocks the docks and prevents Tandem from delivering orders to customers. I've no clue which way things will go but if the price continues to weaken I may buy some more (on the basis that transport will return to normal reasonably quickly).

Kainos Group Bought at 1211p - December 20

This has been a great year for Kainos with public-sector contracts boosting profits. This is no one-off though as sales and profits have been improving for the last five years since listing. Over that period earnings quality has remained high with ROCE consistently above 40% and high FCF conversion in almost all years. As a result the share count has barely risen in this time with net cash on the balance sheet steadily increasing. It's no surprise that Kainos passes all of my quality screens. From a momentum perspective analysts have been raising their estimates since June with the current forecasts of around 30p in earnings (for 2021 and 2022) around double the consensus six months ago. The share price has responded to these upgrades but it's only 60-70% higher than the price seen in the summer. This seems a lot but the price rise is lagging the forecasts and the forward P/E has reduced a little (it's still ~40 so this is no value share). So why buy know? Well the share price is down just over 10% from its October high and has formed a distinct base at 1160p. In the last two months volume on positive days has been distinctly higher than on negative days with much higher volume recently. This suggests to me that buyers are keen but waiting for a break-out (just as happened in August-October). I don't whether this will happen but with the 100-day MA moving towards the base I can see the share price reacting in one way or another.

Fonix Mobile Bought at 126p - December 20

This is a very new addition to the stock market, listing in October. Ordinarily I steer clear of companies with a short public history but this piece by Martin Flitton piqued my interest due to the overlap in some of our holdings. Looking at Stockopedia, growth over the last few years has been very strong with profits rising 158% on an almost doubling of revenue. Margins are high, and rising, while the ROCE and FCF conversion numbers are both very high due to the capital-light business model. In a nutshell Fonix is a mobile payments and messaging platform provider that allows consumers to make payments with their mobile phone. Fonix takes a commission from the end merchant and pays on a commission to the mobile operator; it's the difference between these two numbers that drives profits. Currently Fonix is UK focused with much of its revenue coming from the gaming and charity sectors. Future growth will come from taking carrier billing into new verticals and expanding internationally. So far management don't appear to have put a foot wrong although I do need to go through the admission document to make sure that there's nothing nasty lurking in the fine print. If the prospectus is clean then analyst forecasts for 12% EPS growth in 2021 and 2022 look very undemanding (a point made in the Momentum Investor newsletter recently). I suspect that the broker is being cautious while there's so little information available which is why I've taken an initial position.

Gaming Realms Bought at 20p - December 20

Last week the CEO and Executive Chairman of Gaming Realms presented on Mello Monday to a large group of eager investors. I saw this as a golden opportunity to see management and ask questions for one very good reason: it seems that Gaming Realms has never made a profit and has regularly issued shares to keep the show on the road. In my mind these are not the characteristics of a successful business and a significant pivot needs to have occurred to make the shares investable. Now according to David Thornton of the Growth Company Investor newsletter the big change is a shift from B2C to B2B. Previously management had tried to capture all of the profit by dealing with customers directly but this exposed them to high acquisition costs and onerous regulatory requirements. So a few years ago they decided to distribute non-exclusively through gaming operators and distributors. This removed almost all variable costs and turned the company into a games designer, with valuable IP in its Slingo brand, that make much of its revenue through performance fees. So popular games are important and Gaming Realms are set to benefit from expansion in the USA as more states legalise real-money gaming. This is a huge opportunity and the company is in a great position due to its existing successful relationships. As a result the firm should become FCF breakeven in 2020 with a move into profitability in 2021. If all goes well the stable fixed cost structure will ensure that sales growth falls straight to the bottom-line and profits should rise rapidly. Clearly this is a higher risk investment but the signs look positive.

Sales

3i Group Sold at 1129p - December 20 - 26.9% gain

I've held 3i for just over three years now and they've been a solid if unspectacular investment over that period. The portfolio managers have done a fine job in that time with Action, a huge discount retailer in Europe, being an outstanding success. As a result the share price has rarely traded below the NAV, which has steadily grown, with occasional enthusiasm taking the price up to a 40% premium. This level has represented a resistance level for the past five years and I have no reason to believe that the shares should trade at a higher premium. Right now, with a recent NAV of 905p, the premium is 25% and the shares could easily push on past 1200p. However I need to release some funds for purchases elsewhere and I've dumped my holding to generate liquidity. I will miss having some Private Equity type exposure though.

Hipgnosis Songs Sold at 121p - December 20 - 6.6% gain

All of my shares in Hipgnosis were acquired via PrimaryBid as the manager raised investment funds. I took part in these cash calls partly to test out PrimaryBid and partly because I think that song catalogues are a sensible investment opportunity. However it's become clear that Hipgnosis are going to keep acquiring new catalogues for quite a few years in order to reach their song count target. This means even more fundraising at a discount to NAV which will dilute existing holders. In addition catalogue valuation is an imprecise art and I have some concern around valuations being managed upwards. It would be an easy trap to fall into and it's hard to create a mark-to-market test with every catalogue being unique. So I've taken a moderate gain from the experiment and that's fine.

SDI Group Sold at 102p - December 20 - 78.0% gain

SDI is an excellent company with seasoned, careful management. It's had a surprisingly profitable pandemic with certain divisions benefiting from large, one-off contracts. These won't be repeated in H2 which is why the H1 earnings just reported are more than 50% of analyst forecasts. Some of this gap may be narrowed by acquisition but it's too early to tell how the full year will turn out. Even so investors have become excited lately, with these results and news of a bolt-on purchase, and the shares have risen by more than a third. I can't say that the business is over-priced at these levels but I'd be surprised if the recent buoyancy is sustained without an expectation beating announcement. In this light I expect to see ordinary price volatility bring the share price back down again before a new base can be formed. If I'm right I'll buy back in. If I'm not then that's my loss.

IG Design Group Sold at 603p - December 20 - 8.6% gain

I've been pretty positive on IG Design recently and felt optimistic about their full-year results. I even had my specific concern about the CEO selling all of his shares allayed when he explained that this was a tax planning measure. OK, fine, I can believe that. However now Paul Fineman has sold even more shares - these ones being held in a trust where he has a non-beneficial interest. This follows a number of other director sales in recent weeks with many of these taking their holdings down to minimal levels. There's got to be a red flag here and this time I'm not inclined to ignore the signs. I'd like to see IG Design do well, and their numbers will look good if Sterling continues to weaken, but something isn't right here. I'm out.

Announcements

Belvoir Group

In a remarkable turnaround Belvoir is now trading ahead of pre-Covid expectations. This is really something given how these forecasts fell from 15.2p to 6.1p over the course of the summer. What this says to me is that earnings could be 5-10% better than 15.2p which gives at least 16p for the year, 24% earnings growth from 2019 and a P/E below 10. The key drivers here are strong trading in both the property and financial services divisions combined with a greatly reduced cost base. In fact trading is going so well the board have decided to reimburse staff in full for the salaries which were sacrificed and to repay the Government in full the Covid furlough monies and grants received. Shareholders will receive a further catch-up dividend to make up in full for the previously suspended final dividend. I am very impressed by the actions of the management this year and see this as a good moment to increase my holding. (Update)

Alpha FX

The key fact to note here is that the board anticipate full year earnings to be ahead of expectations. This is great news given how difficult the year has been with their largest client defaulting as markets slumped in March. This slaughtered the share price and for a moment this looked to be a life-or-death challenge for the group. Fortunately the client is financially sound and management were able to agree a realistic payment plan to resolve the default. I'm sure also that this experience has influenced how they manage counterparty risk at Alpha FX. So the fact that trading has remained strong through the Autumn, after recovering in the Summer, suggests that growth is back on track and that five years of uninterrupted profit growth isn't about to end in 2020. Still it's worth recalling that current forecasts are still 15% down from where they were in January and that even a 5-10% uplift here won't recover the lost ground - and yet the share price is almost back to an ATH. I don't see this as a big problem but there could be some price consolidation in the short term. (Update)

Hipgnosis Songs

It's been an incredibly busy year for Hipgnosis with close to £500m in capital raised, and then invested in new catalogues, with a forward pipeline north of £1 billion. It just shows the scale of the music business to consider that the company has acquired 117 catalogues, providing interests in 57,836 songs, and yet this is just a drop in the ocean. Usefully the NAV is up 7.4% to 125p (which is roughly the current share price) with this increase coming from revaluation gains, streaming revenues and a reduction in the discount rate. I'm happy to accept these changes but it's worth remembering that valuation is more of an art than a science with quite a lot of professional latitude. Still revenues have doubled and Hipgnosis have raised their annual dividend target to 5.25p which equates to a yield just over 4%. This income is a big attraction here as licensing revenues should remain stable in all economic environments. In fact I quite enjoy listening to Hipgnosis owned songs on Spotify knowing that in some infinitesimal way I'm adding value to my shares! I'm clearly not alone in streaming more music during the pandemic and the board expect this to be a key driver in growing royalty revenues. I'm sure that they're correct on this front and that in a few years time Hipgnosis will be a much larger fund with operational gearing kicking in as revenues grow more quickly than costs. (Results)

Games Workshop

Hot on the heels of last month's update we now learn that H1 was even more successful than previously thought. On sales of around £185m (25% up on 2019) the PBT will be not less than £90m (52% above the £59m of 2019). Last month management estimated that PBT would not be less than £80m so they've clearly added some high-margin profits lately (perhaps from licensing). Right now analyst forecasts are for full-year PBT of £139m and I find it hard to believe that the company will only make £49m of pre-tax profit in H2. In addition the company is distributing another 60p of surplus cash which is a nice Christmas present. (Update)

Computacenter

Computacenter is coming towards the end of its financial year and the positive momentum of Q2 and Q3 has happily continued into Q4. As a result adjusted PBT should be no less than £190m which is a few percent higher than current forecasts. This puts the company on a P/E of ~18 which seems very reasonable for a high quality business generating double-digit growth on a continuing basis. The next update in late January should add extra detail from the unaudited numbers with some guidance on initial trading in 2021. With the shares down 10% from recent highs there could be a decent buying opportunity here. (Update)

RWS Holdings

A resilient set of results here given the global pandemic. Sales and gross profit were flat, compared to 2019, with a 10% increase in operating costs being offset by the proceeds of a warranty claim. Down at the bottom-line profits were also more or less unchanged with 16.9p of earnings (or 19.9p when adjusted). It could be argued that £4m of acquisition costs should not be adjusted out given that RWS is a serial acquirer. I agree. The £1m of share-based payments is also a real cost to investors. So I see adjusted EPS as more like £65m, down from £73m in 2019, giving an adjusted EPS of 19.0p. Just a 5% change but more of a miss compared to expectations. Not that it matters with the new financial year started and trading being slightly ahead of expectations. The big change for 2021 is the acquisition of SDL. This is a very complementary addition which should deliver far more than the identified synergy benefits of £15m. There was a belief that the customer bases of the two companies were broadly different and that the language technologies of SDL would fit neatly into RWS (given that they already licensed some technology from SDL). A successful integration will clearly be the focus of the board in 2021. It's hard to know how this will all pan out but RWS has an excellent track-record of integrating acquisitions and they are now a leading player in the global translation industry. I am quietly confident that they will continue to do well. (Results)

K3 Capital

I've been positive about K3 Capital ever since they went on the acquisition trail in the summer. Ordinarily a buying spree would be a red flag but in this case management have carefully broadened the scope of the business. This should make profits less cyclical and unlock cross-selling opportunities within the group. In fact KBS was the third largest referrer to Quantuma during the period while 13% of randd's new client mandates were directly attribute to Group referrals. In the first half KBS and rannd trading particularly strongly while Quantuma remained in-line with expectations due to the subdued insolvency market. Overall the group is trading ahead of expectations and the group has entered H2 with significant momentum. Further acquisitions are a possibility but even without them the group looks pretty good value at the moment. (Update)

Tristel

I've been waiting for Tristel to break through the 520p level for six months now. This statement could be the catalyst to make this happen but I suspect that it's not quite punchy enough. Still it's very positive that H1 PBT is expected to increase by no less than 10%, to £3.3m, with this all being down to organic growth. Current FY forecasts are for 15% growth to £7.7m of pre-tax profit so the company is in the right ball-park. Q1 sales were lower than anticipated though due to hospitals still deferring patient procedures. This can't go on forever and from October there has been a substantial recovery in demand. The board expect normal growth to resume in H2 with the new Cache product range contributing materially. So there's plenty to look forward to in 2021. (Update)

Driver Group

Given the difficulties endured during H2 (Apr-Sep) it's impressive that Driver has managed to remain profitable and deliver near to the analyst forecasts. Certainly these were 6% lower, at 5.4p, than the peak estimate of 5.76p in 2019, but there were no revisions to the numbers from February onwards. At the top line sales fell a little from H1 (the H1:H2 split was 53:47) as the economic uncertainty resulted in delays to claims and disputes proceeding. This effect is still apparent as contractors try to complete projects before resorting to dispute resolution but current activity is encouraging and the pandemic will inevitably lead to more work for Driver. Sensibly management responded to these changes by cutting costs and focusing on cash management. As a result profits were equally split between the two halves (when £760K of severance costs for the outgoing CEO are excluded). The new CEO has completed his strategic review and has a clear 5-year plan for growing revenues and moving to a double digit operating profit margin. The key to this is to focus on higher margin Diales revenue, expand geographic presence in a cost-effective manner and share more risk/reward with consultants. Steps have already been taken on this front with the opening of a New York office and it's likely that a few more teams will be added in North/South America. This will allow Driver to access the large number of disputes and claims available in these areas without great expenditure. In time I think that Driver will do well with its new-found focus and refreshed management team. From a technical perspective the share price has formed a downward triangle since peaking exactly seven years ago with firm support at the 45-50p level. So the downside is limited with every chance of a breakout once the news flow turns positive. (Results)

Disclaimer: the author holds, or used to hold, all of the shares discussed here