TL;DR:

Renew Holdings is an impressive turn-around story, with further to go, but the substantial re-rating in share price means that it's no longer cheap and the risk:reward balance does not favour new investors.

A story of three halves

Renew Holdings is an AIM listed engineering services business with a colourful history. Founded as YJ Lovell in 1786 the company prospered for over two hundred years before the wheels came off in the early 1990s; a result of over-diversification and over-confidence. One debt for equity swap later, in 1993, the business stumbled on as YJL Plc until the millennium but it remained one of the walking dead. At the turn of the century another wholesale reorganisation took place and out of the fire-sale, in 2001, emerged Montpellier Group.

However while Montpellier Group looked like a brand-new company, slimmed down and debt free, on the inside it seems that nothing really changed. Just a few short years later, in 2004, problems with incorrectly priced contracts and provisions for losses left the board staring into the abyss. The business model was broken. So once again the company reinvented itself with new management, new acquisitions and new focus; this is how Renew Holdings came to life in 2006. Since then the strategy has been one of growing the core Engineering Services business both organically, and by acquisition, and so far this is working out well.

My point in looking back like this is that while Renew Holdings appears to be a company transformed it's also made repeated visits to the corporate intensive care ward over the last 25 years. Some companies have an internal culture that's accident prone and I do wonder if that's the case here (never mind that the industry is low-margin, competitive and cyclical)? History suggests that sooner or later a contract will turn sour and that's a big risk with such a concentrated client base.

That said for an enterprise built on acquisitions, with group companies continuing to trade under their own good name, it has a clear operational focus in the key markets of Energy (including Nuclear), Environmental and Infrastructure engineering. These areas are largely governed by regulation and benefit from non-discretionary spending programmes giving long-term visibility of committed funding. As a result trading is less exposed to the volatility inherent in the sector and the board should be able to depend on contracted cash-flows.

This change in approach has made Renew Holdings a lot of friends and the stock has been tipped by Questor and other columnists. Good advice it turns out as the share price has rocketed in the last few years; let's take a look to see if the numbers support this trajectory.

Ten years of transformation

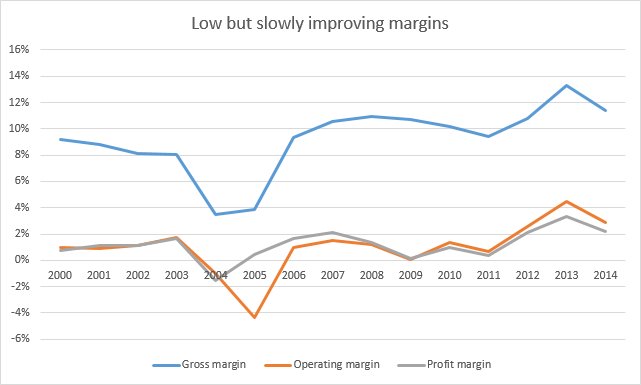

The Construction and Engineering sector is an important one for the country but it's also very cyclical and renowned for operating at very low profit margins. A quick glance at some of the larger companies (Kier, Carillion, Balfour Beatty) in this peer group confirms this; a 2-3% operating margin is common and anything nearing 5% looks outstanding. Renew Holdings is no exception:

That said the recent trend is for increased margins and this is being driven by the board's focus on specialist, non-discretionary engineering projects. In the recent results this margin expansion, and increasing turnover, are specific KPIs: "The Board's ambition is to grow Group revenue to over £500m delivering a Group operating margin of over 4.5% within the next three years."

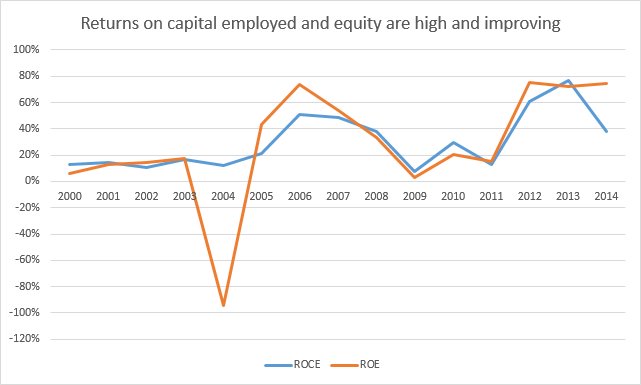

When it comes to the balance sheet of Renew Holdings it's remarkable just how capital-light this business is; in fact the total equity in the business is now less than half of that required just over a decade ago to produce much less profit. This is partly the result of divestment of non-core operations and partly an outcome of how the business is run. Either way the payback is that both the ROE and ROCE are high (impressively so) when the company performs well:

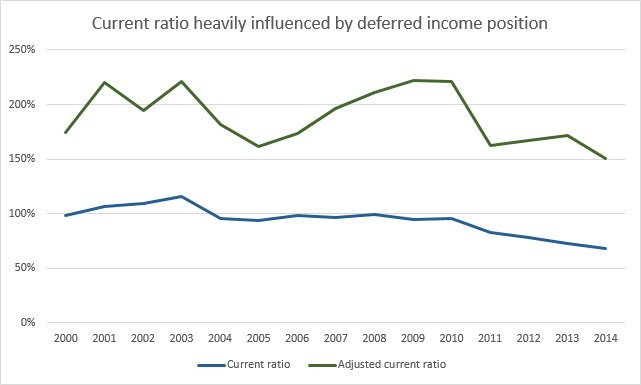

How about when the company isn't performing well though? An accusation often made against Renew Holdings is that it has a very weak balance sheet because the current liabilities vastly out-weigh the available current assets. So if all work stopped, and these liabilities had to be met, then the company would be in serious trouble. This argument is certainly backed-up by a standard measure of liquidity, the current ratio (where >150% is strong and <100% weak):

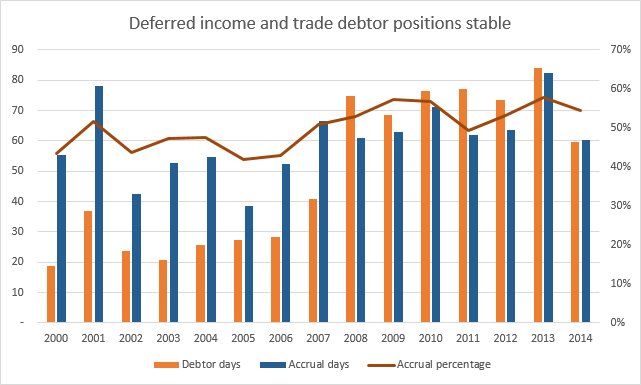

However the main reason why the current liabilities are so high, compared to assets, is that the company holds a high level of Accruals and deferred income on the balance sheet: this is money that customers have paid up front but won't be billed for until a later date. If these funds are adjusted out of the current liabilities then the current ratio looks much more healthy. Of course there is a risk that some of this money might have to be paid back, if a contract is cancelled, or that these funds pile up but never get invoiced. This doesn't appear to be a problem though as the Accruals and deferred income level is fairly steady as a percentage of current liabilities and also as a number of days of turnover:

What's notable in this chart is the trend in debtor days where this indicates how many days of turnover are tied up by trade debtors (i.e. uncollected invoices). A clear step-change took place in 2008 with the average before being under 28 days and the average after jumping to over 73 days. This may not be a concern, in and of itself, given the distinct change in business direction at that time, but any further increase could indicate that debts are becoming noncollectable.

For reference I found a particularly pertinent comment on this point made by an investor with many years of experience in the construction industry: All I would say is look carefully at the Annual Report, taking particular notice of work in progress and the age of unpaid accounts. If there is a huge increase in “aged” accounts beware. Right now Renew Holdings doesn't appear to be piling up invoices that will never get paid but it's something to keep a close eye on.

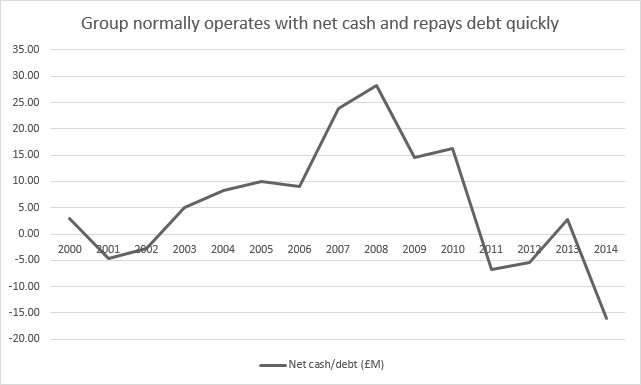

A related aspect of the accounts that I'm always keen to examine is the level of actual cash being generated and how that compares to the reported profits. However it's hard to unravel these accounts and verify the level of cash conversion; there is just such volatility in the underlying profits coupled to noise from large working capital changes, acquisitions and disposals and other restatements. So I've decided to approach this question from another angle by considering whether the company is receiving cash from other sources such as equity placings or debt finance. As such the share count has remained level for a decade and the group has either held net cash or taken on debt but repayed it rapidly:

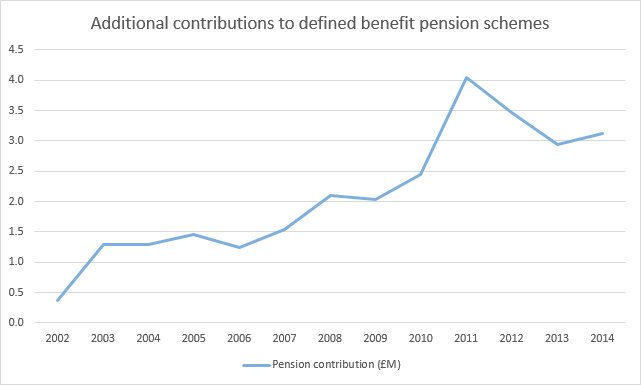

So Renew Holdings must be generating cash internally because it's not sucking in funds from anywhere else and yet still manages to acquire bolt-on enterprises and cover the growing dividend. Off-setting this pleasing cash generation is the fact that even though the final salary pension deficit is under control the company is still locked into making large and increasing cash contributions into the schemes that it's obligated to fund. Given that the payment for 2014 amounted to over £3M that's a hefty drain on resources:

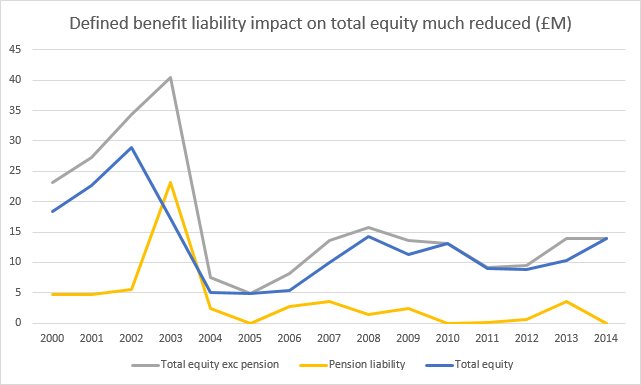

I'm not quite sure how this commitment squares with the fact that the schemes themselves enjoy a greatly reduced liability, compared to a decade ago, and in some cases a small surplus. Either way the impact on total shareholder equity is currently negligible:

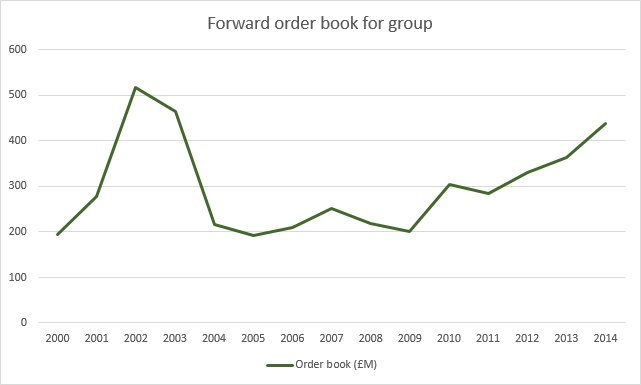

Looking ahead the forward order book indicates that not only is the business growing but that the incrementally-added contracts are of a higher quality (as they're within engineering services) than the ones being delivered. So even though the absolute value of the order book is less than that reached over ten years ago (not adjusted for inflation) the margins (and profits) on this business are much enhanced:

Conclusion

Despite the sensible move into engineering services Renew Holdings remains a heavily cyclical company in a low-margin environment. Management have done well to re-position the company as a supplier of long-term, non-discretionary nuclear, rail and water engineering projects but past history suggests that sooner or later the company will be hit by under-estimated contracts or a recession in the construction industry and shareholders will suffer. The only real uncertainty is when this will happen.

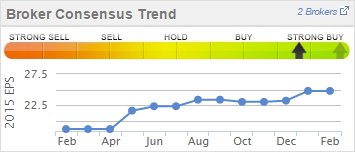

Right now the company is continuing its recovery and the recent, positive AGM statement confirms that trading is in-line with expectations: "The Group order book at 31 December 2014 has increased by 19% to £449m (31 Dec 2013: £376m). The Engineering Services order book stood at £369m (31 Dec 2013: £306m), an increase of 21% over the comparative position last year." This all ties in with the significant change in broker sentiment reported by Stockopedia over the past year; a 33% rise in estimated 2015 earnings per share, to just under 25p, is nothing to be sniffed at and implies a forward P/E of just over 11:

But, in my view, Renew Holdings is a company to buy in the pit of despair when it's on its knees and struggling to stay afloat - not when it's riding high - and it's definitely not a long-term holding that you can tuck away and forget about. The big recovery gains have been made in the last two years and now the company is no longer cheap (for the sector or relative to its own history):

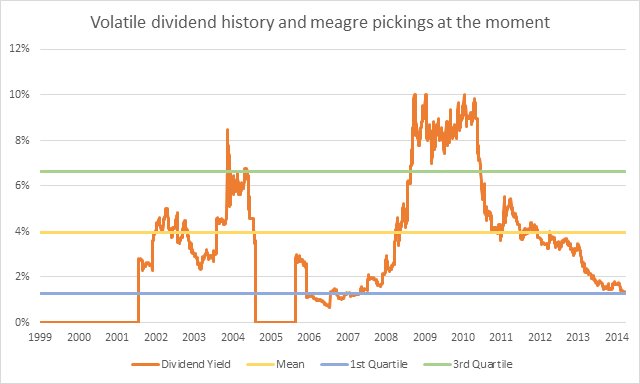

At the same time it currently offers a historically low yield (phenomenally so when contrasted to the sustained yield of 10% available in 2009-10):

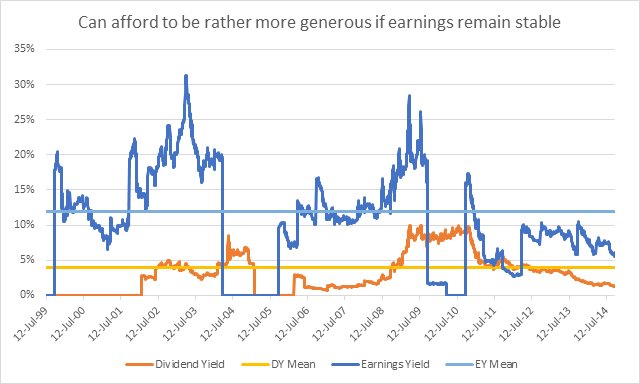

In addition compared to the peer group yields of 4-5% available from much larger companies in the Construction and Engineering sector the 2% or so being paid out here looks pretty puny. There is definitely scope for Renew Holdings to increase its disbursement though when you consider the present dividend cover and earnings yield headroom:

My conclusion, then, is that Renew Holdings has proved to be an excellent recovery stock and that the board are fully in control of this process. If you were looking for a shell that provides engineering services and allows cross-pollination of best practices across the organisation then you probably couldn't hope for better. But I also think that the big gains have been made here and there are other companies available (in the same sector and beyond) which may provide better capital growth and certainly afford a higher income.

Disclaimer: the author holds no shares in this company