When I wrote about Robert Walters in January it was clear to me that this was a solid business that had navigated a number of economic downturns. Which is not to say it's immune to profits collapsing when companies stop hiring but with the eponymous founder still at the reins the firm has prospered for almost 35 years. Previously I speculated that the shares offered decent value and looked set to prosper if macroeconomic concerns eased. Sadly global tensions have, if anything, ratcheted up as demonstrations in Hong Kong add onto Brexit, US-China trade wars and general industrial malaise to dampen optimism. In this light I suppose it's positive that the shares have only fallen 11% during 2019.

The motivation for this post is that Robert Walters put out a Q3 trading update just a few weeks ago and this helped extend a sharp 20% correction in the share price before the recent partial rebound. The catalyst for the de-rating seems to be this key sentence: "Full year profit before tax now expected to be in line with the prior year". Given that analysts had been predicting high single-digit growth up until this point, on the back of solid trading in H1, this warning came as a nasty surprise. In addition the first three quarters of 2019 have produced decent results with Net Fee Income (NFI) up 9% and PBT up 2% in H1 - the latter showing lower growth due to higher finance costs (which I think are down to bringing leaseholds into the accounts as part of IFRS 16). What I want to understand is just how much does the board expect trading to deteriorate in Q4 if it's going to reverse all of the preceding growth?

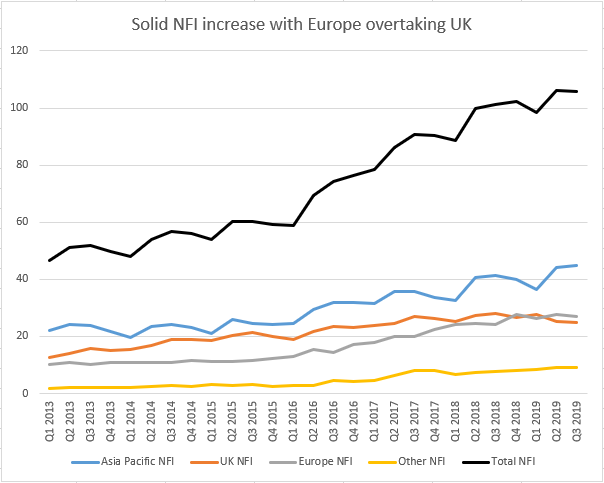

Helpfully Robert Walters provide quarterly updates that specify the NFI (same as gross profit) earned in that period by region. I've collected almost seven years of these updates and it's clear, if you chart just the raw figures, that the group has more than doubled NFI over this period. The largest contribution has consistently come from the Asia Pacific region with Europe overtaking the UK as the latter has gone precisely nowhere since the Brexit referendum:

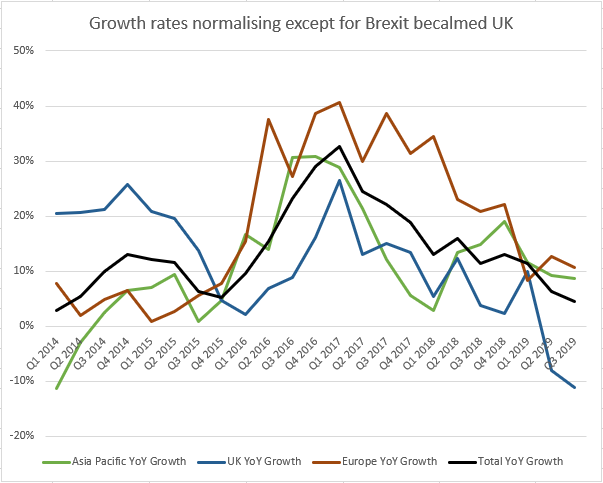

However this aggregation obscures the actual quarterly changes in growth in different regions. If, instead, you graph year-on-year growth for each quarter then it's pretty clear that the group enjoyed a purple patch during 2016-18 with conditions markedly deteriorating over the past year. The fact that recent growth rates are consistent with historical levels is no comfort for investors and it's not surprising that the share price hit at ATH of 796p in September 2018 (before retracing almost 44% to recent lows). A further concern is that the UK business is now actively contracting as we head towards the Brexit deadline and companies are less than enthusiastic about recruitment in any form:

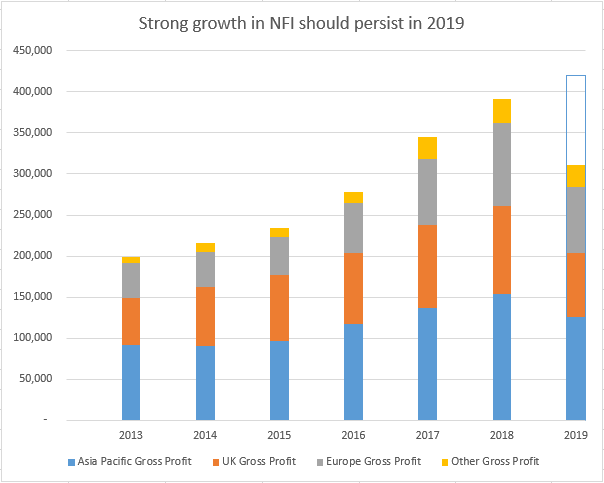

OK so growth rates are moderating but still Asia and Europe grew by ~10% in the last quarter. This is still pretty good and they grew by more than this in H1. In other words the first three quarters of 2019 have produced more NFI than the first three quarters of 2018 (actually 7.3% more). So, initially, I started wondering just how much NFI would have to fall in Q4 2019 in order that we might accrue exactly the same NFI as in 2018 (which was £392m). Given that £310m has already been earned this year this implies the group making just £82m NFI in Q4 - a massive 20% drop compared to 2018. You can also make the case for an even worse fall if you assume that Q4 should follow the trend of Q1-3 and note that the last quarter is usually one of the strongest for trading (on average providing 26% of total yearly NFI). In this scenario you're looking at a 25% fall in NFI compared to expectations. Given the extreme contraction that this would imply across all regions I realised that this scenario didn't make sense. Instead I expect year-on-year growth in total NFI to continue as it has for the last six years:

A further reason to discount this apocalyptic scenario it that the update referred to PBT being in-line and in 2018 the group PBT came in at £49.1m. The sharp-eyed among you will notice that this is a lot less than the gross profit of £392m and an awful lot less than total sales of £1233m. In other words Robert Walters is a low-margin business, like every other recruiter, and subject to hefty operational gearing. This means that if costs remain fixed and NFI falls by 1% (~£4m) then that drop goes straight to the bottom-line and PBT plummets a painful 8%.

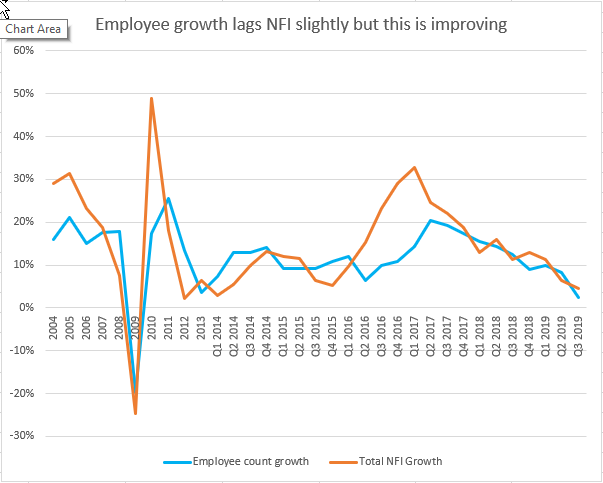

Fortunately, again like its competitors, staff costs are very flexible and staff numbers tend to ebb and flow in line with business volumes. For example in the Q3 update it was pointed out that headcount in the regions most affected by uncertainty had already been reduced with total staff count dropping 2% to 4258 people. Even so there must be additional costs associated with these layoffs and I suspect a certain level of lag as managers keep hoping for an upturn in client calls. This effect can be seen in this comparison of employee and NFI growth rates although the board seem to have reduced this lag in recent years:

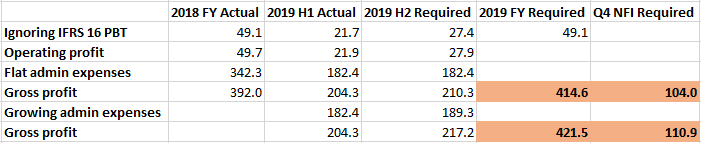

With all of this in mind I've tried to calculate the Q4 NFI required in order that the FY PBT might match that for 2018 (ignoring the impact of IFRS 16 which reduced statutory PBT by £0.8m in H1). The key to working backwards like this is to realise that operating profits have been historically very similar to PBT here and that administration expenses are by far the most important factor to consider. In view of this I've worked out the impact of expenses remaining flat from H1, at £182.4m, and expenses rising by 3.8% as they did in H2 2018:

The upshot is that Q4 NFI needs to be in the range of £104-111m depending on how well administrative expenses are controlled. Typically the last quarter is quite strong with 26% of full-year NFI being generated in the period. If this relationship holds true then we might expect to see £109m NFI in Q4. However we know that conditions are tough so it's likely the Net Fee Income will be more in-line with the preceding quarters at ~£106m with international growth acting to offset further decline in the UK business. If this is the outcome then management will need to be all over the expense costs to protect the bottom line. This is quite achievable but the end result is finely balanced.

Overall I'm pleased to put the recent update into some perspective and the numbers suggest that the company should manage to hit its reduced expectations. After all global stock markets aren't actually crashing despite the pervasive atmosphere of fear. It's frustrating that the UK market is likely to remain weak but the operating margin in the UK, at 2%, is much less than half of the margin achieved elsewhere. So it's better to lose NFI here than in other more profitable regions. On the flip-side further deterioration will put even matching 2018 in doubt and all of these calculations adjust out the impact of IFRS 16 on PBT (a £0.8m headwind in H1). If the latter is included then expectations would become that bit harder to achieve - but I can guarantee that it'll be adjusted out in the next set of results!

Disclaimer: the author holds the share discussed here