Last year was very much a year of transition as I moved from a hybrid high-yield/growth strategy to one focused on quality and momentum. This change was motivated by my increasing confidence in factor based investing (as seen in the Stockopedia StockRank system) and seeing investing friends take profitable advantage of high-quality shares with price/earnings momentum. It's not that I've made terrible returns in the past but I now know that I'm just not a value investor. My record here is patchy, as a result of buying shares that were cheap for a very good reason, and this led to my returns being somewhat volatile.

In addition to changing tack I also took on board the fantastic research done by Stockopedia around profit warnings and my approach since then has been to sell any companies that warn as quickly as possible. This is all about protecting capital and in a similar vein I now employ a 20% stop-loss in order to cut out shares where momentum turns negative; I've seen too many companies reach a peak before relentlessly falling and slashing my overall return. As a caveat this rule is implemented on a case by case basis since I don't necessarily want to drop a company if there really isn't any negative or recent news available.

What surprised me, in putting this review together, is just how many trades it took to achieve this rebalancing; on average more than one a week. For someone who is generally indolent, and believes that this is an excellent attribute for an investor, this level of activity feels like day trading! Anyway what follows are all of my trades and positions, warts and all, ordered by size of gain/loss along with a few comments on the companies that I own where nothing changed (for me) all year.

P.S. There's an obvious pattern to the type of share that I buy and this is because I employ a checklist (which I intend to write about soon). So if my reasons for making a trade start to become repetitive well I apologise in advance but that's the point of a checklist! Feel free to skip over some of my descriptions if this becomes a problem.

Losing trades

LXB Retail Sold at 20.3p after a series of profit warnings - Nov 17 - 45.7% loss

A truly painful experience LXB Retail is a textbook example of not having a plan to protect the downside and then dithering about what to do with an unholy loss. Back in 2015 this seemed like a nice little special situation with a real-estate trust winding up and returning value in excess of the share price. It all started well and a decent slug of money was returned in Nov 2016. Then things took a nasty turn as planning kept being delayed, costs kept rising and the end was nowhere in sight. Obviously I should have thrown in the towel but I really wanted management to turn things around and create some value. In the end I needed these funds elsewhere and decided to the pull the plug; just before the first positive update in a long time!

Carillion Sold at 231p due to hitting stop-loss - Jan 17 - 20.7% loss

This was a pure stop-loss sale as the previous trading update in December was very positive and yet the price continued heading south with barely a ripple. Definitely a lucky escape as a catastrophic profit warning in July, and subsequent warnings, have decimated the share price. At the current price of 18.9p (when I started writing this report) I would be 93.5% down and, of course, the company has now entered liquidation and is a total loss for many small investors.

Ensor Received 53p in liquidation payments so far - Jun 17 - 20.5% loss

Bought to my attention by good friends this looked to be an interesting special situation and I figured that there was some value to be had here. Unfortunately I hadn't reckoned on how the managers of companies in orderly disposal will look after their own at the expense of shareholders. I also hadn't realised just how long it takes to tie up the loose ends in these situations and how costs can eat way at your return. On top of this I bought into the wind-up story way too soon with dreams of a hefty payout when various businesses got sold off. So while the fat lady hasn't sung yet, with a final distribution still to come, I'm drawing a line under this botched opportunity.

Quarto Group Sold at 257p due to FD leaving and hitting stop-loss - Mar 17 - 17.1% loss

Well this company didn't last long in my portfolio (3 months!) after a number of warning signs (FD leaving, tougher markets, loss-making division sold) coincided with a steady drop in share price. When the price dived straight past my stop-loss I didn't hesitate to liquidate my entire holding. Sometimes you just get trades wrong and there's no point in letting your ego get in the way of dealing with them - although the rapid bounce-back made me wonder if I'd been too hasty but further warnings suggest not. At the current price of 143p I would be 53.8% down and pretty cross with myself.

Winning trades

Diageo Sold at 2328p - May 17 - 175.0% gain

By any rational measure Diageo was an astonishingly successful investment and I never expected to sell this position despite its high rating and low yield. However I wanted to invest in some smaller quality shares and something had to go. Fortunately I was in a position to buy a slightly larger position in my wife's portfolio and this made the parting a little more palatable. Still the price is now up to 2672p where my return would sit at a fantastic 216% - wow!

Unilever Sold at 4223p - Jul 17 - 106.8% gain

A solid high-yield position in a high quality company I was pretty loath to part with Unilever. Still I wanted to use the funds elsewhere so out it went (and into my wife's portfolio as it happens). I guess there's a bit of a pattern here but I don't feel too bad about getting my other half to buy companies with this level of quality. Now the price has softened to 4092p and my gain would just have remained in 3 figures at 101%.

Natwest 9% Preference Shares Sold at 162.5p - Nov 17 - 90.8% gain

I first bought these, and other, preference shares back in the teeth of the banking crisis - not as quickly as some but still early enough to make a difference. Over the years they've provided a handsome dividend with excellent capital appreciation. Now though they've got back to where they were in 2006 and have, in fact, risen to an all-time high! As such I can't see that they're going to go much higher although at the current price of 171p my gain would be a tidy 102.0%.

British American Tobacco Sold at 5329p - Jul 17 - 80.2% gain

Another stalwart of pretty much any high-yield portfolio I held BATS for years and pulled in a lot of dividend income as a result. But it had to go in order to fund a couple of decent purchases in smaller companies. Now the price has really come down to 4970p and I would be looking at a "mere" 68.2% profit.

Empresaria Sold at 134p - Aug 17 - 78.5% gain

This was a very big small-cap winner for me at one time but when the price drifted by 20% from the all-time high I decided to reevaluate my position. This was immediately after the interim results announcement and while the numbers seemed pretty good the market really wasn't interested and so I decided to exit. Part of my thinking was that Empresaria is a small company (<£100m) and a little bad news can become a big problem. I was also a concerned about liquidity as the NMS is just 2000 shares (i.e. ~£2680) and low enough to make selling my position trickier than I'd have liked. As it happens a profit warning came out in November and the shares have dropped somewhat since then. Now the price is 99p and I'd only be up by 31.4% - not a disaster by any means but worth avoiding.

BAE Systems Sold at 602p - Jul 17 - 54.9% gain

As one of my remaining high-yield shares, by the middle of the year, I rather liked BAE and felt that it was in a decent place to handle market difficulties. Still I needed its funds and so moved out of this consistent dividend payer. The price currently sits at 572p which would equate to a return of 47.3%.

National Grid Sold at 983p - Mar 17 - 52.2% gain

Another high-yield position that I decided to liquidate rather than buy more of in order to take it up to my average portfolio position size. A solid performer over the years but it had to go as I rationalised my investments. As it happens the price is now 868p and my gain would be down to 35% and falling by the looks of it.

Lavendon Sold at 275p due to takeover - Jan 17 - 43.1% gain

A lucky bidding war meant that I managed to take a position here after the first bid announcement and still made an excellent return. I'd never come across Lavendon before and so I have Paul Scott, and the Small Cap Value Report, to thank for alerting me to the share and a possible tussle between bidders. After several back and forth offers I got out above the final bid price after judging that the losing bidder was taking too much time to respond in the final round. This was very fortunate as my gain would have come in at a still healthy 40.7% if I'd held on.

Man Group Sold at 152p - Apr 17 - 32.5% gain

For sure I had a right old clear out in April and Man Group didn't fit in despite being my previous employer. Strategically they've done alright for themselves over the years and have generated lots of cash but it was time to move on. Sadly for me they've really powered on since then, up to 212p, where my return would have been a hefty 78.6% - double ouch!

Latham (James) Sold at 872p - Dec 17 - 28.8% gain

Now this is a company which I'd long coveted as being a very well-run family company that could be a rewarding hold over the long term. So I was happy to build up a decent holding in 2015 and 2016 when the share price trod water even as the business performed well. However the interim results in November looked, to me, to be quite pessimistic and this seemed to be a view shared by the market as the price slid away. As a result I decided to get out with a healthy gain and wait from the sidelines for any upturn in fortune. While the price eventually fell below 800p it's now at 842p and so I'd still have a gain of 24.4% to be happy with.

Smith & Nephew Sold at 1225p - Apr 17 - 26.0% gain

This was an early quality/growth stock that I bought in 2014 and it remained in my portfolio through being overlooked more than anything else. Still with my rationalisation hat on I decided that while the company looked as solid as ever it just wasn't very exciting. Initially my timing looked poor but with the price back at 1285p my present gain would only be a little higher at 32.4%.

Revolution Bars Sold at 210p - Oct 17 - 16.8% gain

I originally bought Revolution on the basis that it was a cash-positive, self-funding roll-out opportunity that appeared undervalued (hat-tip to SCVR). Unfortunately the FD was asleep at the wheel and a nasty profit warning halved the price overnight. Fortunately for me a minor bidding war broke out not long after and speculation pushed the price over the highest bid price of 205p. After the key cash bid was declared final and as the deadline for the other party approached I decided that they'd just run out of time and ran for the exit. Frankly I was pretty glad to escape with a profit despite Revolution still looking pretty cheap and a bit of a steal. Unbelievably the cash bid failed and the price is back at 167p where I'd be underwater to the tune of -7.1%. Now it's quite likely that there'll be another bid but I also worry that management have been distracted and so I'm staying out for the time being.

Vodafone Sold at 191p - Jan 17 - 9.2% gain

Another high-yield position that I decided to liquidate as the share price had gone nowhere for 5 years and I'd had enough. As luck would have it this was pretty much a low point for the year and with the share price now at 236.8p I'd be looking at a 34.8% gain! Luckily my wife has Vodafone in her portfolio and so we retain some exposure; also I did benefit from the yield of 5% or so for many years and that's some consolation.

SSE Sold at 1454p - Apr 17 - 9.0% gain

Yet another high-yield position which I decided to put to the sword as the share price had gone nowhere for 5 years and I'd had enough. A solid enough performer over the years but it had to go as I rationalised my investable shares. Funnily enough the price is now 1324p and I'd be at just a few pounds less than break-even on my investment.

Royal Dutch Shell Sold at 2101p - Apr 17 - 8.4% gain

OK so this was another very long-term high-yield position (sue me - I had lots of these companies at one point!) that I decided to sell out of as another step to resetting my portfolio. Again I pretty much hit the low point of the year but hey-ho; the price is now 2563p and that would take my return up to 32.5% - ouch.

Aviva Sold at 510p - Oct 17 - 5.5% gain

After topping up on Aviva earlier in the year its momentum faltered and flat-lined - I'd pretty much bought right at this point! As a result the Stockopedia ranks took a bit of a nosedive and in the end I decided to call it a day and deploy the funds elsewhere. Now the price is just a tad lower at 506p and I'd have only a 4.8% gain.

Headlam Group Sold at 529p - Dec 17 - 1.9% gain

Originally bought on the back of a high StockRank and decent quality scores I decided that I didn't like the tone of their December trading update and, after some prevarication, came round to closing my position soon after. In many ways I didn't want to sell this holding but equally my gut felt that something could be wrong; so I plumped for peace of mind and let it go. Since then the price has firmed to 557p and I'd have a slightly more reasonable gain of 7.4%.

Glaxosmithkline Sold at 1445p - Oct 17 - 0.9% gain

A very long-term high-yield constituent I've been waiting forever and a day for GSK to get its act together. Sadly it's gone nowhere for 2 decades and the recent, poorly received, results were the final nail in the coffin for me. Still it's fair to say that I've taken 5-6% yield from this holding for many years and so, overall, I've done just about acceptably but that's generous. Either way the price has fallen further and at 1353p I'd be marginally underwater to the tune of -5.4%.

New positions

Patisserie Holdings Bought Jan 17

To start the year I decided that I liked the look of Patisserie Holdings what with its ROCE of ~21%, net cash position and ability to self-fund the roll out of new stores. At a P/E of ~20 I figured that I wasn't paying too high a price when someone with the track record of Luke Johnson was chairman. Also the results a few months before ended with a positive outlook and, frankly, I like cakes and these are one of the mini-luxury items that people tend to reward themselves with when money is tight. Still looking good in my view.

Headlam Group Bought Jan 17

Okay I ended up selling my holding here for essentially no return but a year ago they looked high quality, not too expensive (P/E ~14) and with a high stock rank of 98. Also the pre-close trading update indicated that profits would be ahead of already revised market expectations. So business was clearly performing strongly and the share price drifted upwards following this announcement. Probably not the worst purchase in the world.

XP Power Bought Jan 17

Another high quality share (ROCE ~24%), not too expensive (P/E ~16) and with a high stock rank I liked the look of XP Power and its general progress. Previously a decent trading statement reported revenues up by 18% with net cash on the balance sheet and good momentum. I just like the quality of the group and decided to make it a full position in January.

Quarto Group Bought Jan 17

A high quality, very cheap (P/E ~7) share with a high stock rank of 99 this seemed like a steal. I'd also seen the top brass present and liked how they were turning the company around and reducing debt. I knew that this was higher risk, due to the debt load, but announcements were positive and I figured that management were delivering on their strategic plan and decided to back them. Oh the benefit of hindsight.

Treatt Bought Feb and May 17

I'd heard about Treatt and its quality from famed investor Lord John Lee but it'd always looked a little expensive. However with its P/E at ~18 while the ROCE hovered at 17% I decided that it was time to invest - especially with earnings upgrade momentum suggesting that analysts were playing catch up. All on the back of two trading statements where profits were reported to be substantially ahead of expectations and then to exceed the revised numbers a month later. Okay there was some uncertainty around moving and consolidating their production site, implying a large slug of capex, but I take this as a sign of a business preparing to grow even more.

Revolution Bars Bought Mar and Jul 17

As mentioned earlier this was another stock bought to my attention by Paul Scott. I agreed with his conclusion that this self-funded roll-out was too cheap with the potential to be taken over. I also figured that the downside was decently protected with cash on the balance sheet but this turned out to be an illusion when the profit warning came out in May and shares more or less halved overnight. According to my rules I should have sold out on the way down but they dropped so quickly I was unable to exit at a price that I felt able to stomach. Luckily they put out a much better update a few months later and this was my cue to double my holding at a much lower price.

Fevertree Drinks Bought Mar, May and Nov 17

I've perhaps gone a little overboard here but this is a high quality company that I've analysed in some depth. It's in no way cheap (P/E ~65) but its history of repeated profit upgrades and out-performance is astonishing. Also looking around showed me how much of a lock they've got on the premium mixer market which convinced me that I should buy sooner rather than later. Pretty much every trading statement seems to say that profits will be ahead, or materially ahead, of expectations and this is an astonishing run of success. Okay the high rating does tend to lead to volatility as investors react strongly to news, or a lack of it, but I think that the management track record speaks for itself.

BHP Billiton Bought Mar 17

A long-standing part of my portfolio, through good times and bad, I decided to bring it into line with the size of my other holdings by buying more. Deciding on a purchase, rather than a sale, came down to the high stock rank of 92 and improving earnings forecasts suggesting a company on the way up independent of my existing investment.

Aviva Bought Mar 17

Another relatively long-standing position, after they took over Friends Life, I decided to make this a full holding along with BLT. Again the high stock rank and improving price suggested to me that this was a company on the way up after 5 years in the doldrums. Essentially this was all about biting the bullet on dealing with a sub-scale position which needed to be disposed of or made whole.

Taptica International Bought Apr and Jul 17

To me eyes Taptica looked like a high quality (ROCE of ~37% although quite volatile) and high stock rank (97) outfit being marked down due to it being a foreign company on AIM. So following Ed Page-Croft's example with his NAPS portfolio I decided to let the numbers do the talking rather than my gut and took an initial position. This was quickly promoted to a full position when they put out a trading statement indicating that profits would be higher than market expectations. To me this is a signal that my initial investment was on the right lines and I'm always happy to buy again following a strong statement even if the price has increased.

Dart Group Bought Apr 17

Another high-quality operation with a high StockRank of 96 I'd previously allowed myself to get stopped out of my position back in 2016. On the face of it this was the right thing to do, given my desire to avoid losses, but the company remained an efficient, growing operation and I decided that I'd been premature to write it off. Maybe the lesson here is not to look back in anger and just to judge companies on their merits at the time of purchase regardless of your history with them.

Polypipe Group Bought Apr and May 17

Purchased on the back of a high StockRank of 88 and high forecast earnings growth of 36% compared to a P/E of ~15, without knowing lots about the company, I was definitely trusting the algorithms here. Digging a little deeper I discovered that the firm operates in a profitable niche around plastic piping and has grown consistently since flotation. However I was premature with my second purchase as the price has gone nowhere since then and there hasn't been any trading news sufficient to boost forecasts. So my rule now is to wait for a strong update or results before upgrading any starter position to a full holding.

XL Media Bought Apr and Jul 17

With a P/E of ~10, ROCE of ~29%, yield >5% and cash on the balance sheet there has to be something seriously wrong with XL Media doesn't there? It's possible but with profits growing at a fair clip I believe that this strongly performing company is marked down by virtue of being foreign and on AIM. Taking this attitude has certainly saved investors from a bushel of Chinese frauds but here I believe in the reported numbers and took an initial position on this basis. Just a few months later I increased this to a full position on the back of a statement indicating that profits would be ahead of management expectations and since then the company has powered ahead.

New River Retail Bought Jul 17

Now NRR is a well run, if cautious, real-estate trust which focuses on community and convenience retailing outside of the capital; the yield is high here (>6%) and I think that management can be trusted. Back in July NRR raised new funds in order to take full control of their BRAVO joint venture with this revolving around 4 convenience-led shopping centres. This transaction made a lot of sense given that NRR had run these centres for 3-4 years already and knew them back to front. With their good track record I was pretty happy to support the deal, and not get diluted but since then the share price has taken a real nose dive and is pretty much equal to the EPRA NAV (when it's been at a premium for years). Hopefully this is just noise and in the long run the value will out.

Accesso Technology Bought Jul 17

I've known about Accesso for probably a decade or more and every time I've looked at it I've judged it to be too expensive. Well history shows that I've been dead wrong every time as this excellent company has gone from strength to strength in both ticketing and new market verticals. Fortunately I've come to realise that sometimes you just need to pay up for quality companies that are growing strongly with a lot of runway to come. So when the price declined by around 20%, from a peak above £20, I figured that this was as good a time as any to get involved.

Games Workshop Bought Jul and Sep 17

A gigantic winner for many investors in 2017 I came very late to the party on the back of excellent quality (40% ROCE!) and StockRank numbers (97!) plus strong trading updates. Even with the profit upgrades and share price appreciation I figured that the shares remained good value on a P/E ~13 and so took a position. Here I was also helped by two trading statements in a row pointing to profits being ahead of expectations and since then Games Workshop hasn't paused for breath.

FDM Group Bought Jul 17

Once again high quality (ROCE ~66%) and momentum scores bought this share to my attention like a moth to a flame. However it was the steady profit growth and cash generation that really sealed the deal here. Frankly this software company appears to be off the radar of most investors, which the company don't do much to change as they issue hardly any announcements, but their growth record is great. I do find this lack of attention remarkable for a billion-pound FTSE 250 company but if they continue to trade well I'll be happy with that.

Burford Capital Bought Jul 17

This is an unusual company that funds well-chosen legal cases and seems to have a decent track record with plans for expansion. It also has some decent quality metrics (ROCE ~13% and profit margin of 72%) and as a result I was happy to initiate a position after their interim results. The only problem is that the company explicitly states that they are unable to make forecasts so you only really get a sense of their progress twice a year. Still they are one of the few listed entities that invests in litigation cases and that makes it pretty counter-cyclical if nothing else.

Computacenter Bought Aug and Oct 17

I guess that the pattern of what I'm looking for in a company is becoming clear as Computacenter is another share where high quality (ROCE ~20%) and earnings upgrade momentum bought it to my attention. After noticing a couple of 'exceed expectations' statements in the year I opened a position immediately upon reading their excellent interim results. The motivation to top-up came with their next, decent trading statement and since then CCC expect to be 'comfortably ahead' of the revised figures. Still looking good then.

IQE Bought Sep and Dec 17

Okay in a break from thinking about StockRanks, and after reading I don't know how many posts about IQE and its different technologies, I finally cracked and took out a position. There's no doubt that IQE doesn't fit my usual desire for high quality and cash generation but sometimes you've got to add a little excitement! Now it did take a nice set of interim results for me to buy in the first place, and I only bought more in December after very positive trading update, but things really haven't gone well so far! The problem is that IQE is a well known trading share and this leads to a lot of volatility as news emerges or time passes and holders get bored. Either way I don't plan on doing anything here until the FY results come out in March - at which point the outlook statement will get some close attention.

Palace Capital Rights issue Oct 17

This is a very frustrating share for me as I very much like the management, appreciate their experience and believe in how they're doing business and yet the company hasn't managed to set the world alight and grow into a really viable scale operation. Then the board announced a big deal for a commercial property portfolio along with a rights issue at a very heavy and painful discount. I really wasn't sure that I wanted to turn my holding here into an outsize position, and seriously contemplated ignoring the rights issue, but in the end I took as much of my allocation as I could afford on the basis that I expect management to deliver NAV growth - some time this century anyway.

Plus 500 Bought Oct and Nov 17

Back in the world of high quality (ROCE ~140%!) and profit growth (~60%) the amazing cheapness of Plus 500 (P/E ~9) forced me to consider its investment potential. Like Taptica this is another foreign AIM share and for many years I'd dismissed it as little more than a tool for separating fools from their money. Lately though it seems to have cleaned up its act and come through difficulties with regulators that would have sunk a lesser company. Even better, multiple trading statements indicated that profits would be ahead of expectations and it's this trend which really drew me towards the company.

Robert Walters Bought Oct and Dec 17

This is an unusual recruiter in that profits have quadrupled in the last 4 years, it has a high ROCE of ~30% and momentum shows no sign of slackening off. Also it's not too expensive on a P/E of ~17, although that's probably about right for a cyclical company, and has a habit of putting out positive trading updates. As such I initially invested, and topped up, on the back of such statements; this sequence of upgrades (obvious in the broker consensus trend graph) really suggests a business that is trading superbly.

3i Group Bought Oct 17

At a market cap of £9bn this is a larger outfit than I normally go for but it's really out-performed over the last four years and continues to have strong earnings and price momentum (along with a ROCE of ~17%). The interim results described a company strongly active in private equity and infrastructure with the experience to invest well in both areas. This ties in with the way in which the company fought back from the financial crisis by focusing on its strengths. It's early days to know how this investment will play out but I'm looking forward to the next portfolio update.

Henry Boot Bought Oct 17

Being in construction this share won't appeal to every investor but like my other holdings it has a high and improving ROCE (~15%) along with broker upgrade momentum and a pretty low P/E of ~11. The catalyst for my purchase was a 'materially ahead' statement which suggested that the company could hardly keep up with the strength of its trading opportunities! Hopefully this doesn't mean that there'll be a short-fall of deals in 2018 but I'll know more with the trading statement that should be available soon.

H&T Group Bought Dec 17

I learnt about H&T from Graham Neary, in the SCVR, and was pretty impressed by its recovery from 2013 and the collapse in the gold price back then. After many difficult years it seemed to hit its stride in 2016, by diversifying somewhat, with its ROCE and earnings figures really benefiting. Ultimately the catalyst for buying now was a sequence of strong trading statements and the sense that the business was prospering in our current economic environment; a further statement in January has confirmed that results will be ahead of expectations yet again and so the momentum continues.

Focusrite Bought Dec 17

This company hasn't been listed for long but it seems to be doing very well in its niche of providing hardware and software products to musicians. Testament to this is the smooth rise in profits over the last few years along with a ROCE of ~28% and a growing level of cash on the balance sheet. While the company keeps a low profile a very recent statement confirms that strong growth continued until the end of the year and I don't see why this trend should change.

DotDigital Bought Dec 17

My final purchase of the year I was, once again, attracted by the shares high ROCE of ~27% combined with smooth earnings growth (and upgrades) plus an increasing level of cash in the bank. So DotDigital very much fits the template of companies that I like to invest in and the December AGM statement reassured me that the company was continuing to perform well. It's likely that a trading statement will emerge soon, with interim results next month, and so the direction of travel will become a lot clearer.

Unchanged positions

Preference shares

I still retain reasonable holdings in Bank of Ireland 13.375% PIBS, Lloyds 9.75% Pref and NatWest 9% Pref shares. These were bought a number of years ago, in the aftermath of the financial crisis, and since then they've provided both decent capital growth and regular dividends. To be honest I think that their recovery is largely played out with their prices now equal to, or even exceeding, the highest price that these instruments have ever reached at any time. With interest rates slowly increasing I imagine that the capital values will slowly diminish to match this normalisation; OTOH the yields are still pretty decent to I'm not intending to sell out imminently.

Berkeley Group

Bought on the back of strong quality scores and an impressive recovery since 2008 these shares were initially pretty weak for me in 2016. However I held on and last year they really powered ahead after the Brexit vote with trading being surprisingly strong despite exposure to the weakening London property market. The board certainly seem confident about the future (although they have to strike something of a cautious tone given how exposed they are to the economy) and I'm happy to hold as they continue making returns of value.

Bioventix

I've held this great little company for a number of years now and I find them an absolute pleasure to hold as they go about their business of constructing antibodies. Obviously one shouldn't fall in love with any company but so far these guys have barely put a foot wrong in exploiting their very profitable medical niche. I can see no reason not to hold an outfit like this.

Next

Talking of falling in love with a company I've long held Next in high esteem. Their results and updates are a model of clarity and are very much the standard to which I hold all other company reports (just about everyone else pales in comparison). Unfortunately this has led to me holding the shares through their multi-year decline long after I should have sold them once they hit the 20% stop-loss level - even though I wasn't using a stop-loss back then! Anyway the firm appears to be, finally, finding its feet again and it still remains a highly profitable and cash generative company so I'm not about to sell up now. A painful hold.

Photo-Me International

This is a tricky share for me as on one hand the company has very successfully recovered from a near-death experience about a decade ago and yet on the other hand I wonder

about the future for their core photo-booth offering. What clinches things for me is that the underlying business throws off a lot of cash and this allows the company to both pay lots of special dividends and still invest in new areas such as their laundromat business. So far this seems to be growing really well and I'm happy enough to hold and see how the story unfolds.

PPHE Hotel Group

Originally bought as a play on the company being very under-valued compared to the assets which it owned over the years I've grown to value the absolute growth of the business and

the expert way in which it is operationally managed. The executive team seem really on the ball and able to guide the company in profitable directions. I don't really know what the catalyst will be which really unlocks the hidden value here but I'm being decently rewarded to just wait and see. Good hold.

RWS Group

This has been a very steady performer for me as the group has capitalised on the cash flow it brings in by acquiring a number of complementary players. This has helped to increase earnings, without diluting shareholders, and allow for some decent cross-selling opportunities. For 2018 profits are expected to materially increase and I see the company maintaining its excellent momentum. Strong hold.

Somero Enterprises

I see Somero as another quality company exploiting a niche profitably by providing an outstanding service to customers. Despite macro-economic concerns the company continues to grow its sales globally, apart from in China - a tough nut to crack, and generates enough cash to fund special dividends occasionally. Trading is buoyant at the moment and the US tax cuts will provide a longer-term tailwind. Strong hold.

Watkin Jones

While Watkin Jones have only been listed for a couple of years they've continued to work their sweet-spot of student accommodation and are moving into the build to rent space. Usefully funding for these developments is provided by forward selling them to investment funds and so the company isn't at all leveraged (quite the opposite). Momentum appears to be continuing and their sector doesn't seem to be running out of steam despite Brexit concerns. Good hold.

Zytronic

These guys have been a strong performer for me ever since their profit warning almost 5 years ago. Every year they keep improving their core products and finding buyers for ever larger screens. Growth may have moderated in recent years but the high return on capital and cash generation keeps me in this share. It's possible that one day they'll get taken over but that's not an outcome that I'm banking on. Good hold.

Concluding thoughts

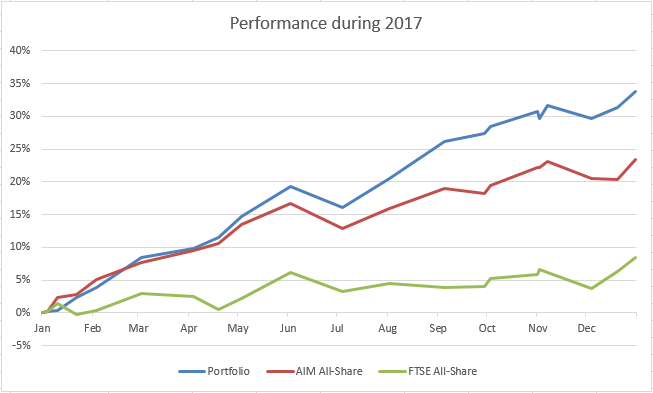

In a storming year for small-cap, momentum shares I managed to grow my portfolio by 33.7%. This is an increase matched only by the bounce-back year of 2009 where my return hit 37% (but that followed a terrible 2008 where I lost 42% overall!). Talk about volatility. I believe that two drivers underpinned behind this performance; the first is that I managed to contain my losses and the second is that I happened to select growth/momentum shares that were in vogue last year:

Now I'm trying to move away from the pattern of following a good year with a very average one but it's too early to say if I'm succeeding in this ambition. What I can say is that I'm getting better at taking a starting position and then doing nothing until a positive update follows; where this confirms whether or not to upgrade to a full position. I'm also getting better at limiting the downside by ruthlessly cutting profit warning companies and other shares that are falling for no reason. The way I look at it is that some of my stock picks will definitely, absolutely go wrong because it's impossible to be right every time. Therefore I need to be ready to accept this, and take a small loss, rather than anchoring on any one position and becoming psychologically trapped. If I can do as well, on this front, this year as I did in 2017 I'll be very pleased:

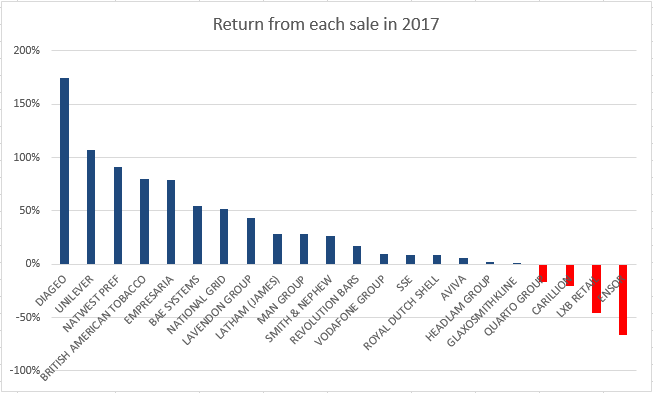

As an exercise on judging whether these were good sells I've worked out what my return would have been had I kept every one of the above positions. While some shares have climbed markedly since being sold (I'm looking at you Man Group) I'm still 7.2% better off (and perhaps a little more now that Carillion has gone bust) than if I had just held on to all of the shares (without counting the gains made by shares bought using these recycled funds). To a limited degree this implies that I made some reasonable decisions but I remain very wary of such a conclusion; all I can really say is that I'm comfortable with my investment process and I believe that it has a reasonable chance of selecting decent companies. Let's hope that I can do as well in 2018!

Disclaimer: Obviously I own, or used to own, all of the shares discussed here